Thursday, August 30, 2012

Monday, August 27, 2012

Monday, August 13, 2012

Sunday, August 12, 2012

Thursday, August 2, 2012

Hey........

Took an unscheduled month off to clean out the offices of Sound Of Cannons Towers East. Truthfully, the John Roberts SCOTUS decision took a lot of wind out of our sails and the current dead heat between the two chuckleheads running for POTUS is depressing as well. But fear not, good readers, we'll get back on track as August slips by and we get into crunch time for the election coverage. Thank you for your patience and understanding.

Nicely Said....................

"The men the American people admire most extravagantly are the most daring liars; the men they detest most violently are those who try to tell them the truth." - H.L. Mencken

17 Reasons Why Those Hoping For A Recession In 2012 Just Got Their Wish

If you were hoping for a recession in 2012, then you are going to be very happy with the numbers you are about to see. The U.S. economy is heading downhill just in time for the 2012 election. Retail sales have fallen for three months in a row for the first time since 2008, manufacturing activity is dropping like a rock, sales of new homes are declining again, consumer confidence has moved significantly lower and a depressingly small percentage of businesses anticipate hiring more workers in the coming months. Even though the Federal Reserve has been wildly pumping money into the financial system and even though the federal government has been injecting gigantic piles of borrowed cash into the economy, we still haven't seen an economic recovery. In fact, we appear to be on the verge of yet another major downturn. In California the other night, Barack Obama told supporters that "we tried our plan — and it worked", but only those that are still drinking the Obama kool-aid would believe something so preposterous. The truth is that the U.S. economy has been steadily declining for many years and now we have reached another very painful recession.

If you were hoping for a recession in 2012, then you are going to be very happy with the numbers you are about to see. The U.S. economy is heading downhill just in time for the 2012 election. Retail sales have fallen for three months in a row for the first time since 2008, manufacturing activity is dropping like a rock, sales of new homes are declining again, consumer confidence has moved significantly lower and a depressingly small percentage of businesses anticipate hiring more workers in the coming months. Even though the Federal Reserve has been wildly pumping money into the financial system and even though the federal government has been injecting gigantic piles of borrowed cash into the economy, we still haven't seen an economic recovery. In fact, we appear to be on the verge of yet another major downturn. In California the other night, Barack Obama told supporters that "we tried our plan — and it worked", but only those that are still drinking the Obama kool-aid would believe something so preposterous. The truth is that the U.S. economy has been steadily declining for many years and now we have reached another very painful recession.Let me give you an example. If I could go out overnight and magically double the bank accounts of every single American, would we all be twice as wealthy?

No, because there would be twice as many dollars now chasing the same amount of goods and services. The price of those goods and services would soon rise dramatically to reflect this new reality.

With all of those new dollars spinning around in the economy it would look like "economic growth" was going through the roof, but in reality the amount of real economic activity would be about the same.

So whenever we talk about GDP, we need to properly adjust it for inflation. That means using accurate inflation figures and not the highly manipulated inflation figures that the U.S. government is putting out these days.

And as I noted the other day, after properly adjusting for inflation the U.S. economy has been continually experiencing negative economic growth since about 2005.

So let's not deceive ourselves. The U.S. economy has been declining for a long time.

But soon even the GDP number that the government gives us will turn negative. We will probably see a slightly positive number for the second quarter, and the number will likely go negative either in the third quarter or the fourth quarter.

Economists will debate when this new recession officially "began" just like they do with every recession, but it doesn't take a genius to figure out what is happening to our economy right now.

The following are 17 reasons why those hoping for a recession in 2012 just got their wish....

1. U.S. retail sales have declined for three months in a row. This is the first time this has happened since 2008. Every other time this has happened in U.S. history (except for once) this has signaled that the U.S. economy was either already in a recession or was about to enter one.

2. The Philadelphia Fed index of manufacturing activity contracted for the third month in a row during July. According to the Financial Post, this is a very bad sign....

Seven out of eight times when the average reading has been that low (-11.8) for that long the U.S. economy has tipped into recession.3. Manufacturing activity in the mid-Atlantic region has also declined for three months in a row. In fact, the only time in the past decade when manufacturing activity in the mid-Atlantic has fallen more dramatically was during the last recession.

4. A factory index calculated by the Institute for Supply Management has fallen to its lowest level since June 2009.

5. The Conference Board index of leading economic indicators has fallen for two of the past three months.

6. According to a recent survey conducted by the Conference Board, only 17 percent of CEOs had a positive view of the economy during the second quarter of 2012. During the first quarter of 2012, 67 percent did.

7. Gallup's U.S. Economic Confidence Index is now the lowest that it has been since January.

8. Optimism among small business owners has declined in three of the last four months and is now at its lowest level since last October.

9. Believe it or not, the amount of waste being carted around on trains in the United States has an 82 percent correlation with U.S. economic growth. Unfortunately, right now the number of garbage carloads on trains is falling dramatically.

10. Sales of previously occupied homes dropped by 5.4 percent during June.

11. Sales of new homes declined by 8.4 percent during June. At this point new home sales are less than a third of what they were during the boom years.

12. An increasing number of Americans are relying on high interest "payday loans" to pay the rent and put food on the table.

13. Far more companies are defaulting on their debts this year than last year.

14. According to the U.S. Labor Department, the unemployment rate fell in 11 states and Washington, D.C. last month, but it rose in 27 states.

15. The unemployment rate in New York City is now back up to 10 percent. That equals the peak unemployment rate in New York City during the last recession.

16. The teen unemployment rate in Washington D.C. right now is 51.7 percent.

17. A recent survey conducted by the National Association for Business Economics found that only 23 percent of all U.S. companies plan to hire more workers over the next 6 months. When the same question was asked a few months ago that number was at 39 percent.

All of those are very powerful pieces of evidence that a new recession has started.

But do you want to know one of my favorite indicators that the U.S. economy is sliding into recession?

In a previous article, I noted that Federal Reserve Chairman Ben Bernanke made the following statement to Congress recently: "At this point we don't see a double dip recession. We see continued moderate growth."

As I mentioned the other day, Bernanke has a track record of failure that is absolutely embarrassing. Back on January 10, 2008 Bernanke made the following statement....

"The Federal Reserve is not currently forecasting a recession."That turned out to be a great call, didn't it?

On June 10, 2008 he doubled down on his call that the U.S. economy was going to avoid a recession....

"The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so."Just before Fannie Mae and Freddie Mac collapsed Bernanke made this statement....

"The GSEs are adequately capitalized. They are in no danger of failing."And there are dozens of other examples just like these.

This is the guy running our economic system.

I am very critical of the Federal Reserve, but there are very good reasons for this.

The Federal Reserve is running our economy into the ground, and we need to pound this into the heads of the American people so that they will wake up and demand change.

Perhaps this next recession will be painful enough to wake people up.

The Wall Street Journal is already even using the "D word" to describe what we are experiencing. Just today, the Wall Street Journal ran an article that asked this question: "Do Two Recessions Equal One Depression?"

Sadly, this is just the leading edge of what is coming. By the time 2014 or 2015 rolls around, we are going to look back and long for the "good old days" of 2011 and 2012.

Over the next few years, the unemployment rate is going to skyrocket and poverty in the United States is going to get a whole lot worse.

Now is not the time to goof off. Now is the time to work really hard to get yourself and your family into the best position that you can for the storm that is coming.

Nothing is going to stop the terrible economic crisis that is coming, but at least we can get prepared for it.

There is hope in being prepared.

Sadly, most people will never even see the next crisis coming until they get blindsided by it.

11 Signs That Time Is Quickly Running Out For The Global Financial System

Are we rapidly approaching a moment of reckoning for the global financial system? August is likely to be a relatively slow month as most of Europe is on vacation, but after that we will be moving into a "danger zone" where just about anything could happen. Historically, a financial crisis has been more likely to happen in the fall than during any other time, and this fall is shaping up to be a doozy. Much of the focus of the financial world is on whether or not the euro is going to break up, but even if the authorities in Europe are able to keep the euro together we are still facing massive problems. Countries such as Greece and Spain are already experiencing depression-like conditions, and much of the rest of the globe is sliding into recession. Unemployment has already risen to record levels in some parts of Europe, major banks all over Europe are teetering on the brink of insolvency, and the flow of credit is freezing up all over the planet. If things take a really bad turn, this crisis could become much worse than the financial crisis of 2008 very quickly.

All over the world people are starting to write about the possibility of a major economic crisis starting this fall.

All over the world people are starting to write about the possibility of a major economic crisis starting this fall.The consensus? The world economy has entered a final countdown with three months left, and investors should pencil in a collapse in either August or September.The global financial system is so complex and there are so many thousands of moving parts that it is always difficult to put an exact date on anything. In fact, history is littered with economists that have ended up looking rather foolish by putting a particular date on a prediction.

Citing a theory he has been espousing since 2010 that predicts "a future lack of policy flexibility from the monetary and fiscal side," Jim Reid, a strategist at Deutsche Bank, wrote a note Tuesday that gloated "it feels like Europe has proved us right."

"The U.S. has the ability to disprove the universal nature of our theory," Reid wrote, but "if this U.S. cycle is of completely average length as seen using the last 158 years of history (33 cycles), then the next recession should start by the end of August."

But without a doubt we are starting to see storm clouds gather for this fall.

The following are 11 more signs that time is quickly running out for the global financial system....

#1 A number of very important events regarding the financial future of Europe are going to happen in the month of September. The following is from a recent Reuters article that detailed many of the key things that are currently slated to occur during that month....

In that month a German court makes a ruling that could neuter the new euro zone rescue fund, the anti-bailout Dutch vote in elections just as Greece tries to renegotiate its financial lifeline, and decisions need to be made on whether taxpayers suffer huge losses on state loans to Athens.#2 Reuters is reporting that Spanish Economy Minister Luis de Guindos has suggested that Spain may need a 300 billion euro bailout.

On top of that, the euro zone has to figure out how to help its next wobbling dominoes, Spain and Italy - or what do if one or both were to topple.

#3 Spain continues to slide deeper into recession. The Spanish economy contracted 0.4 percent during the second quarter of 2012 after contracting 0.3 percent during the first quarter.

#4 The unemployment rate in Spain is now up to 24.6 percent.

#5 According to the Wall Street Journal, a new 30 billion euro hole has been discovered in the financial rescue plan for Greece.

#6 Morgan Stanley is projecting that the unemployment rate in Greece will exceed 25 percent in 2013.

#7 It is now being projected that the Greek economy will shrink by a total of 7 percent during 2012.

#8 German Finance Minister Wolfgang Schäuble says that the rest of Europe will not be making any more concessions for Greece.

#9 The UK economy has now plunged into a deep recession. During the second quarter of 2012 alone, the UK economy contracted by 0.7 percent.

#10 The Dallas Fed index of general business activity fell dramatically to -13.2 in July. This was a huge surprise and it is yet another indication that the U.S. economy is rapidly heading into a recession.

#11 As I have written about previously, a banking crisis is more likely to happen in the fall than at any other time during the year. The global financial system will enter a "danger zone" starting in September, and none of us need to be reminded that the crashes of 1929, 1987 and 2008 all happened during the second half of the year.

So is there any hope on the horizon?

European leaders have tried short-term solution after short-term solution and none of them have worked.

Now countries all over Europe are sliding into depression and the authorities in Europe seem to be all out of answers. The following is what one eurozone diplomat said recently....

"For two years we've been pumping up the life raft, taking decisions that fill it with just enough air to keep it afloat even though it has a leak," the diplomat said. "But now the leak has got so big that we can't pump air into the raft quickly enough to keep it afloat."The boat is filling up with water faster than they can bail it out.

So what is the solution?

Well, some of the top names in economics on both sides of the Atlantic are urging authorities to keep the debt bubble pumped up by printing lots and lots more money.

For example, even though the U.S. government is already running trillion dollar deficits New York Times "economist" Paul Krugman is boldly proclaiming that now is the time to print and borrow even more money. He is proud to be a Keynesian, and he says that "you should be a Keynesian, too."

Across the pond, the International Business Editor of the Telegraph, Ambrose Evans-Pritchard, is strongly urging the ECB to print more money....

Needless to say, I will be advocating 1933 monetary stimulus à l'outrance, or trillions of asset purchases through old fashioned open-market operations through the quantity of money effect (NOT INTEREST RATE 'CREDITISM') to avert deflation – and continue doing so until nominal GDP is restored to its trend line, at which point the stimulus can be withdrawn again.But is more money and more debt really the solution to anything?

In the United States, M2 recent surpassed the 10 trillion dollar mark for the first time ever. It has increased in size by more than 5 times over the past 30 years.

Unfortunately, our debt has been growing much faster than GDP has over that time period.

For example, during the second quarter of 2012 U.S. government debt grew by 274.3 billion dollars but U.S. GDP only grew by 117.6 billion dollars.

Our problem is not that there is not enough money floating around.

Our problem is that there is way, way too much debt.

But this is how things always go with fiat currencies.

There is always the temptation to print more.

That is one of the big reasons why every single fiat currency in history has eventually collapsed.

Printing more money will not solve our problems. It will just cause our problems to take a different form.

In the end, nothing that the authorities can do will be able to avert the crisis that is coming.

A lot of people are starting to realize this, and that is one reason why we are seeing so much economic pessimism right now.

For example, according to a new Rasmussen poll only 14 percent of all Americans believe that children in America today will be "better off" than their parents.

That is an absolutely stunning figure, but it just shows us where we are at.

Our economy has been in decline for a long time, and now we are rapidly approaching another major downturn.

You better buckle up, because this downturn is not going to be pleasant at all.

Just Open Up Your Eyes And Look - 65 Signs That The Economic Collapse Is Already Happening

Do you want to know when the "economic collapse" is going to happen? Just open up your eyes and take a look. The "economic collapse" is already happening all around us. So many people talk about the coming economic collapse as if it is some massively hyped event that they will be able to point to on the calendar, and a lot of writers spend a lot of time speculating about exactly when it will happen. But as I have written about before, the economic collapse is not a single event. The economic collapse has been happening, it is happening right now, and it will be getting a lot worse. Yes, there will be moments of great crisis. We saw one of those "waves" back in 2008 and another "wave" is rapidly approaching. But all of the waves are part of a process that is continually unfolding. Over the past 40 years, the United States and Europe have piled up the greatest mountain of debt in the history of the world, and now a tremendous amount of pain is heading our way. Economic conditions in the United States and Europe have already deteriorated badly and they are going to continue to deteriorate. Nothing is going to stop what is coming.

But many people are still in denial about our economic decline. Some people still believe that everything is going to be just fine. Way too often I get comments on my site that go something like this....

But many people are still in denial about our economic decline. Some people still believe that everything is going to be just fine. Way too often I get comments on my site that go something like this....You get the idea.

I definitely understand that most Americans are terribly self-involved these days, but when I read comments like this I am once again amazed at just how delusional some people can be.

Why can't people just open their eyes and look at the evidence of economic collapse that is all around us?

Yes, there are wealthy enclaves all over the country where things may seem better than ever, but that is not the reality for most Americans.

All over the country, our infrastructure is in shambles.

All over the country, our once proud cities are being transformed into hellholes.

All over the country, formerly middle class families are living in their cars.

There are dozens and dozens of economic statistics that clearly show that we are in the midst of a long-term economic decline. I have listed 65 of them below, but I could have easily doubled or tripled the size of the list.

I simply do not understand how anyone can believe that things are "great" or that the U.S. economy is going to be "just fine".

We are living through a complete and total economic nightmare, and hopefully we can get more Americans to wake up from their entertainment-induced comas so that they can begin to understand exactly what is happening to this country.

The following are 65 signs that the economic collapse is already happening all around us....

1. Since Barack Obama entered the White House, the number of long-term unemployed Americans has doubled from 2.7 million to 5.4 million.

2. The average duration of unemployment in the United States is nearly three times as long as it was back in the year 2000.

3. The unemployment rate in the U.S. has been above 8 percent for 40 months in a row, and 42 percent of all unemployed Americans have been out of work for at least half a year.

4. Unemployment in the eurozone has hit another brand new record high. It is now sitting at 11.2 percent. It has risen for 14 months in a row.

5. The U.S. economy lost more than 220,000 small businesses during the recent recession.

6. The percentage of Americans that are self-employed fell by more than 20 percent between 1991 and 2010.

7. Overall, the number of "new entrepreneurs and business owners" dropped by a staggering 53 percent between 1977 and 2010.

8. The unemployment rate in Spain is now up to 24.6 percent.

9. Morgan Stanley is projecting that the unemployment rate in Greece will exceed 25 percent in 2013.

10. Since Barack Obama became president, the price of a gallon of gasoline has risen from $1.85 to $3.49.

11. The average American household spent approximately $4,155 on gasoline during 2011, and electricity bills in the U.S. have risen faster than the overall rate of inflation for five years in a row.

12. About three times as many new homes were sold in the United States in 2005 as will be sold in 2012.

13. While Barack Obama has been in the White House, home values in the United States have declined by 12 percent.

14. According to AARP, 600,000 American homeowners that are 50 years of age or older are currently in foreclosure.

15. Right now there are now 20.2 million Americans that spend more than half of their incomes on housing. That represents a 46 percent increase from 2001.

16. According to Gallup, the current level of homeownership in the United States is the lowest that they have ever measured.

17. Federal housing assistance increased by a whopping 42 percent between 2006 and 2010.

18. In some areas of Detroit, Michigan you can buy a three bedroom home for just $500.

19. All around us our cities are crumbling. According to the American Society of Civil Engineers, 2.2 trillion dollars is needed just to repair critical infrastructure in the United States.

20. The unemployment rate in New York City is now back up to 10 percent. That equals the peak unemployment rate in New York City during the last recession.

21. Back in 1950, more than 80 percent of all men in the United States had jobs. Today, less than 65 percent of all men in the United States have jobs.

22. The U.S. Postal Service is about to default on a 5.5 billion dollar payment for future retiree health benefits.

23. According to Graham Summers, "when we account for all the backdoor schemes Germany has engaged in to prop up the EU, Germany's REAL Debt to GDP is closer to 300%."

24. According to the Federal Reserve, the median net worth of families in the United States declined "from $126,400 in 2007 to $77,300 in 2010".

25. The U.S. trade deficit with China during 2011 was 28 times larger than it was back in 1990.

26. The United States has lost more than 56,000 manufacturing facilities since 2001.

27. During 2010 alone, an average of 23 manufacturing facilities permanently shut down in the United States every single day.

28. The U.S. government says that the number of Americans "not in the labor force" rose by 17.9 million between 2000 and 2011. During the entire decade of the 1980s, the number of Americans "not in the labor force" rose by only 1.7 million.

29. Eight million Americans have "left the labor force" since the recession supposedly ended. If those Americans were added back into the unemployment figures, the unemployment rate would be somewhere up around 12 percent.

30. Approximately 53 percent of all U.S. college graduates under the age of 25 were either unemployed or underemployed last year.

31. At this point, one out of every four American workers has a job that pays $10 an hour or less. If that sounds like a high figure, that is because it is. Today, the United States actually has a higher percentage of workers doing low wage work than any other major industrialized nation does.

32. Back in 1980, less than 30% of all jobs in the United States were low income jobs. Today, more than 40% of all jobs in the United States are low income jobs.

33. According to one study, between 1969 and 2009 the median wages earned by American men between the ages of 30 and 50 declined by 27 percent after you account for inflation.

34. In 2007, the unemployment rate for the 20 to 29 age bracket was about 6.5 percent. Today, the unemployment rate for that same age group is about 13 percent.

35. According to the Bureau of Economic Analysis, health care costs accounted for just 9.5% of all personal consumption back in 1980. Today they account for approximately 16.3%.

36. Medicare spending increased by 138 percent between 1999 and 2010.

37. Over the next 75 years, Medicare is facing unfunded liabilities of more than 38 trillion dollars. That comes to $328,404 for each and every household in the United States.

38. Back in 1990, the federal government accounted for 32 percent of all health care spending in America. Today, that figure is up to 45 percent and it is projected to surpass 50 percent very shortly.

39. Back in 1965, only one out of every 50 Americans was on Medicaid. Today, one out of every 6 Americans is on Medicaid, and things are about to get a whole lot worse. It is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls.

40. Since 2008, the U.S. economy has lost 1.3 million jobs while at the same time 3.6 million more Americans have been added to Social Security's disability insurance program.

41. Since Barack Obama entered the White House, the number of Americans living in poverty has risen by 6.4 million.

42. The number of Americans on food stamps has risen from 32 million to 46 million since Barack Obama became president.

43. Right now the poverty rate for children living in the United States is 22 percent, and approximately one-fourth of all American children are enrolled in the food stamp program at this point.

44. The number of children living in poverty in the state of California has increased by 30 percent since 2007.

45. Child homelessness in the United States has risen by 33 percent since 2007.

46. According to the National Center for Children in Poverty, 36.4 percent of all children that live in Philadelphia are living in poverty, 40.1 percent of all children that live in Atlanta are living in poverty, 52.6 percent of all children that live in Cleveland are living in poverty and 53.6 percent of all children that live in Detroit are living in poverty.

47. Approximately 57 percent of all children in the United States are living in homes that are either considered to be either "low income" or impoverished.

48. According to the U.S. Census Bureau, the percentage of Americans living in "extreme poverty" is now sitting at an all-time high.

49. In the United States today, somewhere around 100 million Americans are considered to be either "poor" or "near poor".

50. It is now being projected that about half of all American adults will spend at least some time living below the poverty line before they turn 65.

51. Total home mortgage debt in the United States is now about 5 times larger than it was just 20 years ago.

52. Total consumer debt in the United States has risen by 1700 percent since 1971.

53. Recently it was announced that total student loan debt in the United States has passed the one trillion dollar mark.

54. According to one recent survey, approximately one-third of all Americans are not paying their bills on time at this point.

55. In 1983, the bottom 95 percent of all income earners in the United States had 62 cents of debt for ever dollar that they earned. Today, the bottom 95 percent of all income earners in the United States have $1.48 of debt for every dollar that they earn.

56. The United States was once ranked #1 in the world in GDP per capita. Today we have slipped to #12.

57. According to the U.S. Census Bureau, 49 percent of all Americans live in a home where at least one person receives benefits from the federal government. Back in 1983, that number was below 30 percent.

58. Incredibly, 37 percent of all U.S. households that are led by someone under the age of 35 have a net worth of zero or less than zero.

59. Today there are approximately 25 million American adults that are living with their parents.

60. The U.S. dollar has lost more than 96 percent of its value since 1900. You can thank the Federal Reserve system for that.

61. During the Obama administration, the U.S. government has accumulated more debt than it did from the time that George Washington took office to the time that Bill Clinton took office.

62. Overall, the U.S. national debt has grown by nearly 10 trillion dollars over the past decade.

63. The U.S. national debt is now more than 22 times larger than it was when Jimmy Carter became president.

64. 40 years ago the total amount of debt in America (government, business and consumer) was less than 2 trillion dollars. Today it is nearly 55 trillion dollars.

65. As Financial Armageddon recently point out, so many homeless people are pooping on the escalators at San Francisco's Civic Center Station at night that the escalators are breaking down and repair teams have been called in to clean up the mess. As the economy gets even worse, will scenes like this start playing out in all of our cities?

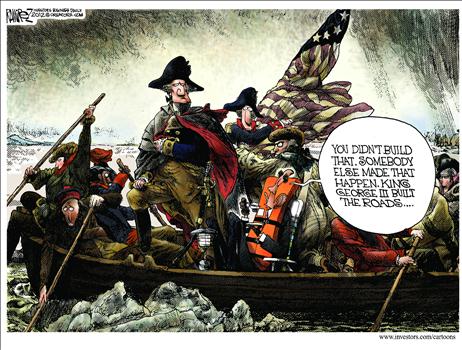

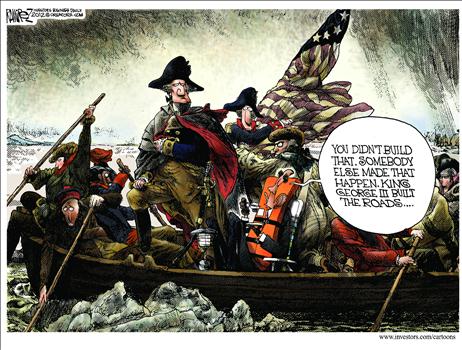

A Funny Look at Obama’s You-Didn’t-Build-That Comment

We've made serious points about how government plays a very important role in the lives of entrepreneurs.

But since I was talking about the staggering burden of red tape and regulation, I wasn’t being very supportive of the President’s assertion that government deserves a big chunk of the credit when a business is successful.

This cartoon makes the same point, but adds taxation to the mix.

As far as I recall (I sound like a politician under oath when I write something like that), this is the first Branco cartoon I’ve used, but I think it’s the best one in this post, so I’m looking forward to more of his (her?) work.

Regular readers know about Michael Ramirez, of course, and he has an amusing take on the you-didn’t-build-that controversy.

I’ve used lots of Ramirez cartoons over the past few years, and you can enjoy some of his work here, here, here, here, here, here, here, here, here, here, here, here, here, here, and here.

The Obama campaign has been complaining that the President’s words were misinterpreted, so this Eric Allie cartoon is quite amusing and appropriate.

You can laugh at more Allie cartoons here, here, here, and here.

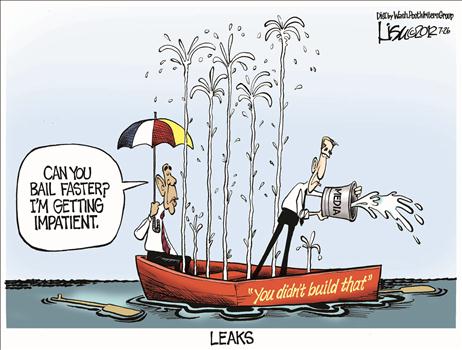

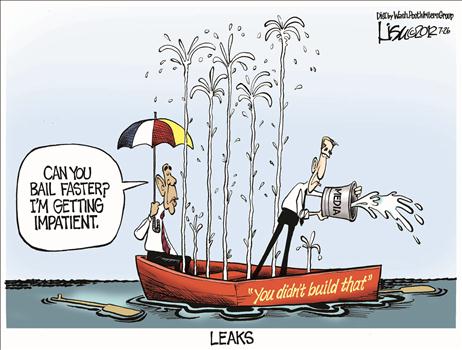

Fortunately for Obama, he has some allies to help him out, as Lisa Benson reminds us.

More funny Lisa Benson cartoons can be seen here, here, here, here, here, here, here, here, and here.

Last but not least, we have another Allie cartoon. I think this is the first time I’ve used two cartoons by the same person, but I think you’ll agree they’re worth sharing.

This gives me an opportunity to end on a serious note. The Obama campaign is asserting that the President was simply stating that private sector prosperity is made possible by the provision of “public goods” such as roads and bridges.

This is a perfectly fair point, as I explain in this video about the Rahn Curve.

But what Obama conveniently overlooks is that spending on so-called public goods is only about 10 percent of the federal budget. The vast majority of government spending is for unambiguously harmful outlays on transfers, consumption, and entitlements.

Which is why the second Allie cartoon is so good. Even when government does something that is theoretically good, it causes a lot of collateral damage because of the excessive size and scope of the welfare state.

But since I was talking about the staggering burden of red tape and regulation, I wasn’t being very supportive of the President’s assertion that government deserves a big chunk of the credit when a business is successful.

This cartoon makes the same point, but adds taxation to the mix.

As far as I recall (I sound like a politician under oath when I write something like that), this is the first Branco cartoon I’ve used, but I think it’s the best one in this post, so I’m looking forward to more of his (her?) work.

Regular readers know about Michael Ramirez, of course, and he has an amusing take on the you-didn’t-build-that controversy.

I’ve used lots of Ramirez cartoons over the past few years, and you can enjoy some of his work here, here, here, here, here, here, here, here, here, here, here, here, here, here, and here.

The Obama campaign has been complaining that the President’s words were misinterpreted, so this Eric Allie cartoon is quite amusing and appropriate.

You can laugh at more Allie cartoons here, here, here, and here.

Fortunately for Obama, he has some allies to help him out, as Lisa Benson reminds us.

More funny Lisa Benson cartoons can be seen here, here, here, here, here, here, here, here, and here.

Last but not least, we have another Allie cartoon. I think this is the first time I’ve used two cartoons by the same person, but I think you’ll agree they’re worth sharing.

This gives me an opportunity to end on a serious note. The Obama campaign is asserting that the President was simply stating that private sector prosperity is made possible by the provision of “public goods” such as roads and bridges.

This is a perfectly fair point, as I explain in this video about the Rahn Curve.

But what Obama conveniently overlooks is that spending on so-called public goods is only about 10 percent of the federal budget. The vast majority of government spending is for unambiguously harmful outlays on transfers, consumption, and entitlements.

Which is why the second Allie cartoon is so good. Even when government does something that is theoretically good, it causes a lot of collateral damage because of the excessive size and scope of the welfare state.

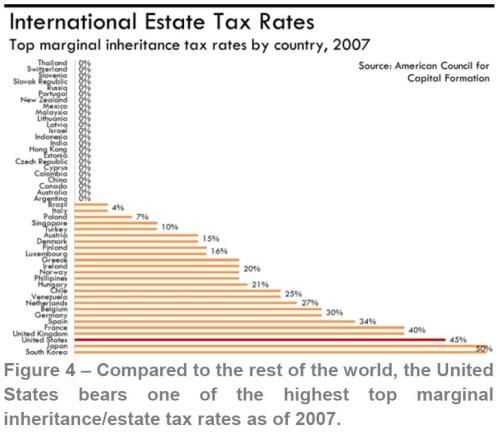

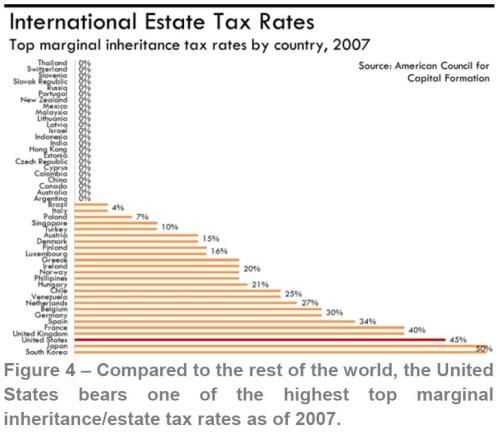

On Death Tax, the U.S. Is Worse than Greece, Worse than France, and Even Worse than Venezuela

Considering that every economic theory agrees that living standards and worker compensation are closely correlated with the amount of capital in an economy (this picture is a compelling illustration of the relationship), one would think that politicians – particularly those who say they want to improve wages – would be very anxious not to create tax penalties on saving and investment.

Yet the United States imposes very harsh tax burdens on capital formation, largely thanks to multiple layers of tax on income that is saved and invested.

But we compound the damage with very high tax rates, including the highest corporate tax burden in the developed world.

And the double taxation of dividends and capital gains is nearly the worst in the world (and will get even worse if Obama’s class-warfare proposals are approved).

To make matters worse, the United States also has one of the most onerous death taxes in the world. As you can see from this chart prepared by the Joint Economic Committee, it is more punitive than places such as Greece, France, and Venezuela.

Who would have ever thought that Russia would have the correct death tax rate, while the United States would have one of the world’s worst systems?

Fortunately, not all U.S. tax policies are this bad. Our taxation of labor income is generally not as bad as other industrialized nations. And the burden of government spending in the United States tends to be lower than European nations (though both Bush and Obama have undermined that advantage).

And if you look at broad measures of economic freedom, America tends to be in – or near – the top 10 (though that’s more a reflection of how bad other nations are).

But these mitigating factors don’t change the fact that the U.S. needlessly punishes saving and investment, and workers are the biggest victims. So let’s junk the internal revenue code and adopt a simple and fair flat tax.

Yet the United States imposes very harsh tax burdens on capital formation, largely thanks to multiple layers of tax on income that is saved and invested.

But we compound the damage with very high tax rates, including the highest corporate tax burden in the developed world.

And the double taxation of dividends and capital gains is nearly the worst in the world (and will get even worse if Obama’s class-warfare proposals are approved).

To make matters worse, the United States also has one of the most onerous death taxes in the world. As you can see from this chart prepared by the Joint Economic Committee, it is more punitive than places such as Greece, France, and Venezuela.

Who would have ever thought that Russia would have the correct death tax rate, while the United States would have one of the world’s worst systems?

Fortunately, not all U.S. tax policies are this bad. Our taxation of labor income is generally not as bad as other industrialized nations. And the burden of government spending in the United States tends to be lower than European nations (though both Bush and Obama have undermined that advantage).

And if you look at broad measures of economic freedom, America tends to be in – or near – the top 10 (though that’s more a reflection of how bad other nations are).

But these mitigating factors don’t change the fact that the U.S. needlessly punishes saving and investment, and workers are the biggest victims. So let’s junk the internal revenue code and adopt a simple and fair flat tax.

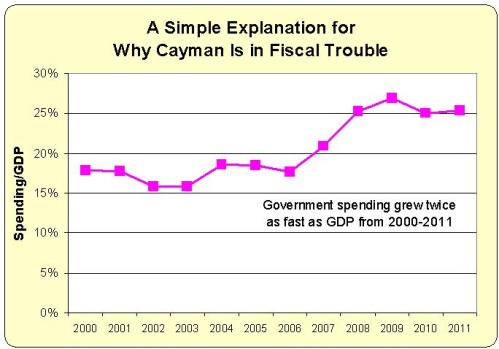

Why The Cayman Islands Are Considering Financial Suicide

What Do Greece, the United States, and the Cayman Islands Have in Common?

At first, this seems like a trick question. After all, the Cayman Islands are a fiscal paradise, with no personal income tax, no corporate income tax, no capital gains tax, and no death tax.

By contrast, Greece is a bankrupt, high-tax welfare state, and the United States sooner or later will suffer the same fate because of misguided entitlement programs.

But even though there are some important differences, all three of these jurisdictions share a common characteristic in that they face fiscal troubles because government spending has been growing faster than economic output.

I’ve written before that the definition of good fiscal policy is for the private sector to grow faster than the government. I’ve humbly decided to refer to this simple principle as Mitchell’s Golden Rule, and have pointed out that bad things happen when governments violate this common-sense guideline.

I’ve written before that the definition of good fiscal policy is for the private sector to grow faster than the government. I’ve humbly decided to refer to this simple principle as Mitchell’s Golden Rule, and have pointed out that bad things happen when governments violate this common-sense guideline.

In the case of the Cayman Islands, the “bad thing” is that the government is proposing to levy an income tax, which would be akin to committing fiscal suicide.

The Cayman Islands are one of the world’s richest jurisdictions (more prosperous than the United States according to the latest World Bank data), in part because there are no tax penalties on income and production.

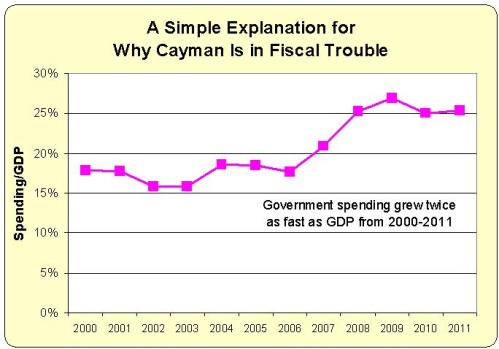

So why are the local politicians considering a plan to kill the goose that lays the golden eggs? For the simple reason that they have been promiscuous in spending other people’s money. This chart shows that the burden of government spending in the Cayman Islands has climbed twice as fast as economic output since 2000.

Much of this spending has been to employ and over-compensate a bloated civil service (in this respect, Cayman is sort of a Caribbean version of California).

In other words, the economic problem is that there has been too much spending, and the political problem is that politicians have been trying to buy votes by padding government payrolls (a problem that also exists in America).

The right solution to this problem is to reduce the burden of government spending back to the levels in the early part of last decade. The political class in Cayman, however, hopes it can prop up its costly bureaucracy with a new tax – which euphemistically is being called a “community enhancement fee.”

The politicians claim the tax will only be 10 percent and will only be imposed on the expat community. But it’s worth noting that the U.S. income tax began in 1913 with a top rate of only 7 percent and it affected less than 1 percent of the population. But that supposedly benign tax has since become a monstrous internal revenue code that plagues the nation today.

Except the results will be even worse in Cayman because the thousands of foreigners who are being targeted easily can shift their operations to other zero-income tax jurisdictions such as Bermuda, Monaco, or the Bahamas. Or they can decide that to set up shop in places such as Hong Kong and Singapore, which have very modest income tax burdens (and the ability to out-compete Cayman in other areas).

As a long-time admirer of the Cayman Islands, I desperately hope the government will reconsider this dangerous step. The world already has lots of examples of nations that are following bad policy. We need a few places that are at least being semi-sensible.

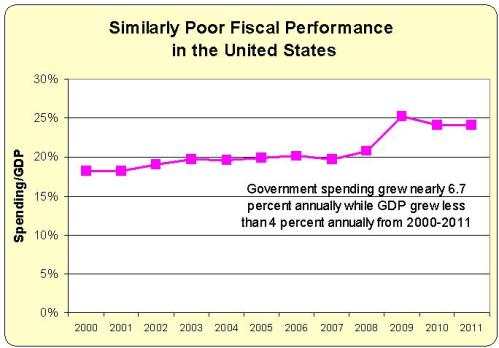

By they way, I started this post with a rhetorical question about the similarities of Greece, the United States, and the Cayman Islands. Let’s elaborate on the answer.

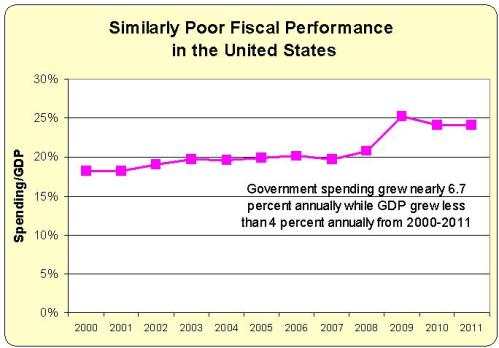

Here’s a post that shows how Greece’s fiscal nightmare developed. But let’s show a separate chart for the burden of federal spending in the United States.

What’s remarkable is that the federal government and the Cayman Islands government have followed very similar paths to fiscal trouble. Indeed, Caymanian politicians have achieved the dubious distinction of increasing the burden of government spending at a faster rate than even Bush and Obama. No mean feat.

This data for the U.S. chart doesn’t include the burden of state and local government spending, so the Cayman Islands still has an advantage over the United States, but I’ll close with a prediction.

If the Cayman Islands adopts an income tax – regardless of whether they call it a community enhancement fee (to misquote Shakespeare, a rotting fish on the beach by any other name would still smell like crap), it will be just a matter of time before the burden of government spending becomes even more onerous and Cayman loses its allure and drops from being one of the world’s 10-richest jurisdictions.

Which will be very sad since I’ll now have to find a different place to go when America suffers its Greek-style fiscal collapse.

At first, this seems like a trick question. After all, the Cayman Islands are a fiscal paradise, with no personal income tax, no corporate income tax, no capital gains tax, and no death tax.

By contrast, Greece is a bankrupt, high-tax welfare state, and the United States sooner or later will suffer the same fate because of misguided entitlement programs.

But even though there are some important differences, all three of these jurisdictions share a common characteristic in that they face fiscal troubles because government spending has been growing faster than economic output.

I’ve written before that the definition of good fiscal policy is for the private sector to grow faster than the government. I’ve humbly decided to refer to this simple principle as Mitchell’s Golden Rule, and have pointed out that bad things happen when governments violate this common-sense guideline.

I’ve written before that the definition of good fiscal policy is for the private sector to grow faster than the government. I’ve humbly decided to refer to this simple principle as Mitchell’s Golden Rule, and have pointed out that bad things happen when governments violate this common-sense guideline.In the case of the Cayman Islands, the “bad thing” is that the government is proposing to levy an income tax, which would be akin to committing fiscal suicide.

The Cayman Islands are one of the world’s richest jurisdictions (more prosperous than the United States according to the latest World Bank data), in part because there are no tax penalties on income and production.

So why are the local politicians considering a plan to kill the goose that lays the golden eggs? For the simple reason that they have been promiscuous in spending other people’s money. This chart shows that the burden of government spending in the Cayman Islands has climbed twice as fast as economic output since 2000.

Much of this spending has been to employ and over-compensate a bloated civil service (in this respect, Cayman is sort of a Caribbean version of California).

In other words, the economic problem is that there has been too much spending, and the political problem is that politicians have been trying to buy votes by padding government payrolls (a problem that also exists in America).

The right solution to this problem is to reduce the burden of government spending back to the levels in the early part of last decade. The political class in Cayman, however, hopes it can prop up its costly bureaucracy with a new tax – which euphemistically is being called a “community enhancement fee.”

The politicians claim the tax will only be 10 percent and will only be imposed on the expat community. But it’s worth noting that the U.S. income tax began in 1913 with a top rate of only 7 percent and it affected less than 1 percent of the population. But that supposedly benign tax has since become a monstrous internal revenue code that plagues the nation today.

Except the results will be even worse in Cayman because the thousands of foreigners who are being targeted easily can shift their operations to other zero-income tax jurisdictions such as Bermuda, Monaco, or the Bahamas. Or they can decide that to set up shop in places such as Hong Kong and Singapore, which have very modest income tax burdens (and the ability to out-compete Cayman in other areas).

As a long-time admirer of the Cayman Islands, I desperately hope the government will reconsider this dangerous step. The world already has lots of examples of nations that are following bad policy. We need a few places that are at least being semi-sensible.

By they way, I started this post with a rhetorical question about the similarities of Greece, the United States, and the Cayman Islands. Let’s elaborate on the answer.

Here’s a post that shows how Greece’s fiscal nightmare developed. But let’s show a separate chart for the burden of federal spending in the United States.

What’s remarkable is that the federal government and the Cayman Islands government have followed very similar paths to fiscal trouble. Indeed, Caymanian politicians have achieved the dubious distinction of increasing the burden of government spending at a faster rate than even Bush and Obama. No mean feat.

This data for the U.S. chart doesn’t include the burden of state and local government spending, so the Cayman Islands still has an advantage over the United States, but I’ll close with a prediction.

If the Cayman Islands adopts an income tax – regardless of whether they call it a community enhancement fee (to misquote Shakespeare, a rotting fish on the beach by any other name would still smell like crap), it will be just a matter of time before the burden of government spending becomes even more onerous and Cayman loses its allure and drops from being one of the world’s 10-richest jurisdictions.

Which will be very sad since I’ll now have to find a different place to go when America suffers its Greek-style fiscal collapse.

International Data on Living Standards Show that the United States Should Not Become More Like Europe

I’m not a big fan of international bureaucracies, particularly the Paris-based Organization for Economic Cooperation and Development. The OECD, funded by American tax dollars, has become infamous for its support of statist pro-Obama policies.

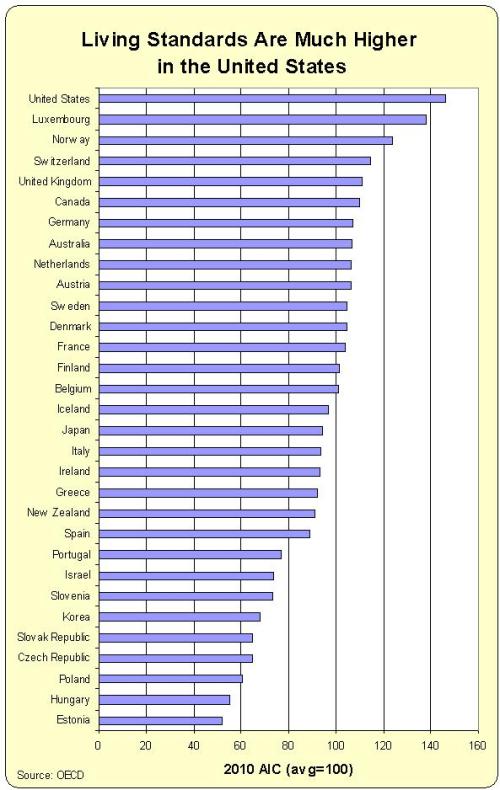

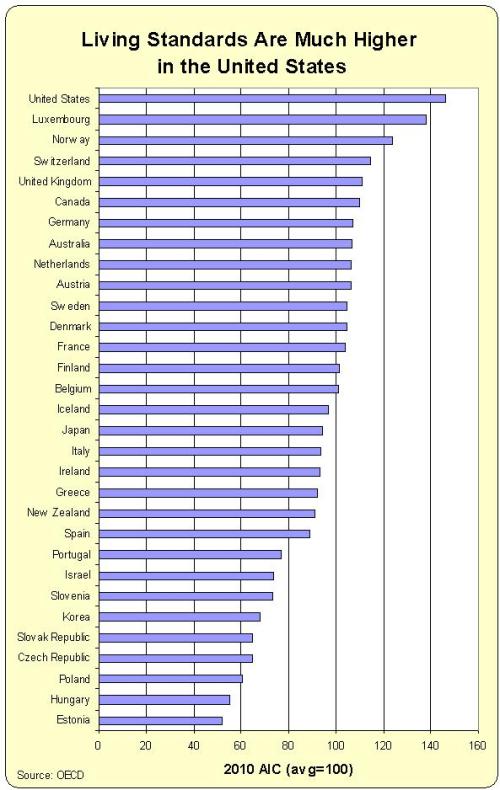

With that being said, let’s look at some truly remarkable statistics from the OECD website on comparative living standards in industrialized nations. This chart shows average levels of individual consumption (AIC) for 31 OECD countries. There are several possible measures of prosperity, including per-capita GDP. All are useful, but AIC is thought to best capture the well-being of a people.

As you can see from this chart, the United States ranks far ahead of other nations. The only countries that are even close are Luxembourg, which is a tiny nation that also serves as a tax haven (a very admirable policy, to be sure), and Norway, which is a special case because of oil wealth.

At the risk of making an understatement, this data screams, “THE U.S. SHOULD NOT BECOME MORE LIKE EUROPE.”

For all intents and purposes, Americans are about 40 percent better off than their European counterparts, in part because we have less government and more economic freedom.

Yet Obama, with his plans to exacerbate class-warfare taxation and further expand the burden of government spending, wants America to be more like nations that have lower living standards.

And don’t forget European living standards will presumably fall even further – relative to the U.S. – as the fiscal crisis in nations such as Greece, Spain, and Italy spreads to other welfare states such as France and Belgium

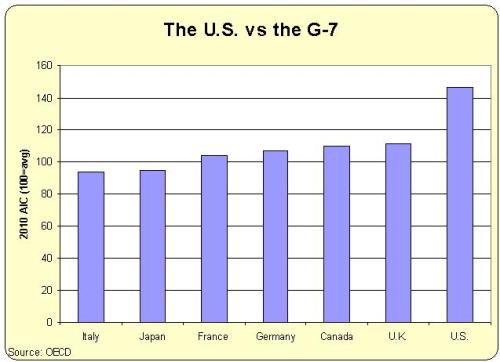

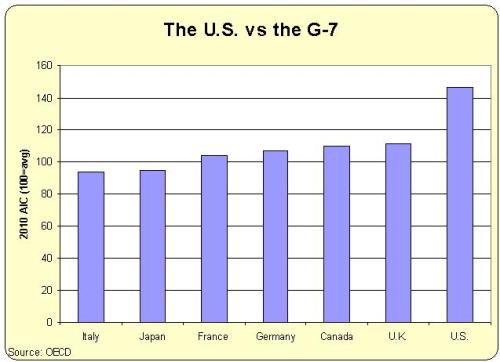

Here’s another chart that looks at the G-7 nations. Once again, the gap between the U.S. and the rest of the world is remarkable.

Maybe, just maybe, the United States should try to copy nations that are doing better, not ones that are doing worse. Hong Kong and Singapore come to mind.

Getting there is simple. Just reduce the size and scope of government.

- The OECD has allied itself with the nutjobs from the so-called Occupy movement to push for bigger government and higher taxes.

- The OECD, in an effort to promote redistributionism, has concocted absurdly misleading statistics claiming that there is more poverty in the US than in Greece, Hungary, Portugal, or Turkey.

- The OECD is pushing a “Multilateral Convention” that is designed to become something akin to a World Tax Organization, with the power to persecute nations with free-market tax policy.

- The OECD supports Obama’s class-warfare agenda, publishing documents endorsing “higher marginal tax rates” so that the so-called rich “contribute their fair share.”

With that being said, let’s look at some truly remarkable statistics from the OECD website on comparative living standards in industrialized nations. This chart shows average levels of individual consumption (AIC) for 31 OECD countries. There are several possible measures of prosperity, including per-capita GDP. All are useful, but AIC is thought to best capture the well-being of a people.

As you can see from this chart, the United States ranks far ahead of other nations. The only countries that are even close are Luxembourg, which is a tiny nation that also serves as a tax haven (a very admirable policy, to be sure), and Norway, which is a special case because of oil wealth.

At the risk of making an understatement, this data screams, “THE U.S. SHOULD NOT BECOME MORE LIKE EUROPE.”

For all intents and purposes, Americans are about 40 percent better off than their European counterparts, in part because we have less government and more economic freedom.

Yet Obama, with his plans to exacerbate class-warfare taxation and further expand the burden of government spending, wants America to be more like nations that have lower living standards.

And don’t forget European living standards will presumably fall even further – relative to the U.S. – as the fiscal crisis in nations such as Greece, Spain, and Italy spreads to other welfare states such as France and Belgium

Here’s another chart that looks at the G-7 nations. Once again, the gap between the U.S. and the rest of the world is remarkable.

Maybe, just maybe, the United States should try to copy nations that are doing better, not ones that are doing worse. Hong Kong and Singapore come to mind.

Getting there is simple. Just reduce the size and scope of government.

Read This Horrifying George Will Column and You Will – if You Have any Decency – Become a Libertarian

I periodically provide mind-blowing examples of individuals who have their lives turned upside down by evil bureaucrats.

You may think “evil” is too strong a word, but it sticks in my mind after perusing these examples of abusive actions by the federal government.- A story of vicious IRS persecution.

- Two stories of innocent people who were victimized by the idiotic Drug War.

- A video about how the EPA tried – and fortunately failed – to destroy a family.

- A story about the Justice Department’s discriminatory attack on a hapless homeowner.

Will starts by describing the federal bureaucracy’s attack on an innocent woman for a non-crime.

But it gets worse, because the federal jack-boots then raided her office (I don’t even know what “jack-boots” are, but they signify government thuggery, and that’s definitely a good description of what happened).…our unhinged government, with an obsession like that of Melville’s Ahab, has crippled Nancy Black’s scientific career, cost her more than $100,000 in legal fees — so far — and might sentence her to 20 years in prison. This Kafkaesque burlesque of law enforcement began when someone whistled. Black, 50, a marine biologist who also captains a whale-watching ship, was with some watchers in Monterey Bay in 2005 when a member of her crew whistled at the humpback that had approached her boat, hoping to entice the whale to linger. Back on land, another of her employees called the National Oceanic and Atmospheric Administration (NOAA) to ask if the whistling constituted “harassment” of a marine mammal, which is an “environmental crime.” NOAA requested a video of the episode, which Black sent after editing it slightly to highlight the whistling. NOAA found no harassment — but got her indicted for editing the tape, calling this a “material false statement” to federal investigators, which is a felony under the 1863 False Claims Act, intended to punish suppliers defrauding the government during the Civil War.

…after this bizarre charge — that she lied about the interaction with the humpback that produced no charges — more than a dozen federal agents, led by one from NOAA, raided her home. They removed her scientific photos, business files and computers.This unfortunate woman has also been charged with another non-crime.

She has also been charged with the crime of feeding killer whales when she and two aides were in a dinghy observing them feeding on strips of blubber torn from their prey — a gray whale. To facilitate photographing the killers’ feeding habits, she cut a hole in one of the floating slabs of blubber and, through the hole, attached a rope to stabilize the slab while a camera on a pole recorded the whales’ underwater eating. So she is charged with “feeding” killer whales that were already feeding on a gray whale they had killed. She could more plausibly be accused of interfering with the feeding.As an aside, Will notes that the NOAA bureaucrats have little regard for the Constitution.

Six years ago, NOAA agents, who evidently consider the First Amendment a dispensable nuisance, told Black’s scientific colleagues not to talk to her and to inform them if they were contacted by her or her lawyers. Since then she has not spoken with one of her best friends.Most important, he concludes with the key point about how all of us are threatened by Leviathan.

In 1980, federal statutes specified 3,000 criminal offenses; by 2007, 4,450. They continue to multiply. Often, as in Black’s case, they are untethered from the common-law tradition ofmens rea, which holds that a crime must involve a criminal intent — a guilty mind. Legions of government lawyers inundate targets like Black with discovery demands, producing financial burdens that compel the innocent to surrender in order to survive. The protracted and pointless tormenting of Black illustrates the thesis of Harvey Silverglate’s invaluable 2009 book, “Three Felonies a Day: How the Feds Target the Innocent.” Silverglate, a civil liberties lawyer in Boston, chillingly demonstrates how the mad proliferation of federal criminal laws — which often are too vague to give fair notice of what behavior is proscribed or prescribed — means that “our normal daily activities expose us to potential prosecution at the whim of a government official.” Such laws, which enable government zealots to accuse almost anyone of committing three felonies in a day, do not just enable government misconduct, they incite prosecutors to intimidate decent people who never had culpable intentions. And to inflict punishments without crimes. …The more Americans learn about their government’s abuse of criminal law for capricious bullying, the more likely they are to recoil in a libertarian direction and put Leviathan on a short leash.Utterly disgusting. As Glenn Reynolds periodically suggests, “tar, feathers” would be an appropriate way of dealing with these hyenas.

By the way, government thuggery is not limited to the crowd in Washington.

- If you have a soul, you will be outraged by this example of a local government abusing poor people.

- If you have decency, you will be disgusted by this example of a state government persecuting someone who didn’t commit a crime.

- If you believe in basic rights, you will be horrified by this example of a foreign government seeking to outlaw political dissent and free speech.

The Latest News on Tax Fairness

If fairness in paying taxes means the amount you pay is based on the amount you make, then the only group in America paying at least a "fair share" is the top 20%—people who make more than $74,000. For everyone else, the tax code is a bargain.

You wouldn't know this from President Obama's rhetoric, but our tax system, according to a recent report by the Congressional Budget Office (CBO), is incredibly progressive. Consider: The top 1% of income earners pay an average federal tax rate of 28.9%. (See the nearby table.) The average federal tax rate on the top 20% is 23.2%. The 20% of taxpayers earning between $50,100 and $73,999 pay an average 15.1%, and so on down the line. The CBO report includes payroll as well as income taxes paid.

There's also another way of looking at fairness, and that's the tax burden. Here, consider the top 20% of income earners (over $74,000). They make 50% of the nation's income but pay nearly 70% of all federal taxes.

The remaining 30% of the tax burden is borne by 80% of the taxpayers, those who make less than $74,000. In short, this group's share of taxes paid, 30%, is lower than the share of income they earn, 50%.

The remaining 30% of the tax burden is borne by 80% of the taxpayers, those who make less than $74,000. In short, this group's share of taxes paid, 30%, is lower than the share of income they earn, 50%.

Yet President Obama says that "for some time now, when compared to the middle class," the wealthy "haven't been asked to do their fair share."

He's right that the system isn't fair, but not because the top 1% pay too little. It is because they pay too much.

Mr. Obama has said that some wealthy employers pay a lower tax rate than their secretaries. True, some are able to lower their effective federal tax rate by giving millions to charity. Or because they derive much of their income as capital gains or from tax-free municipal bonds.

But middle- and low-income Americans who do not invest also pay lower rates thanks to the deductions they receive, such as a $1,000 per child tax credit (which phases out for couples who make more than $110,000), or the Earned Income Tax Credit, which no one making more than $50,000 is supposed to receive.

The CBO report ("The Distribution of Household Income and Federal Taxes, 2008 and 2009") covers the years 1979-2009. It makes plain that the impression conveyed by the president about what upper-income Americans pay in taxes does not hold up to scrutiny.

First of all, the share of taxes paid by the top 20% has gone up over the last 30 years, while the share of taxes paid by everyone else has gone down. It has gone up despite the tax cuts enacted by President Clinton in 1997 and by President Bush in 2001 and 2003. But that makes no difference to the president. The only group of taxpayers he calls on to "sacrifice" are those already doing all the tax sacrificing.

The top 20% in 1979 made 44.9% of the nation's income and paid 55.3% of all federal taxes. Thirty years later, the top 20% made 50.8% of the nation's income and their share of federal taxes paid had jumped to 67.9%.

And the top 1%? In 1979, this group earned 8.9% of the nation's income and paid 14.2% of all federal taxes. In 2009, they earned 13.4% of the nation's income but their share of the federal tax burden rose to 22.3%.

Meanwhile, the federal tax burden on middle- and lower-income earners is lighter. In 1979, the bottom 20% paid barely any taxes at all, just 2.1%. Now their share of taxes is a minuscule 0.3%. The burden on the middle-income earners ($34,900 to $50,100) has dropped too. In 1979, they paid 13.6% of all federal taxes; in 2009 they paid 9.4%.

One reason our country is so divided is because the president keeps dividing us. If taxes need to be raised to fight a war or fund a cause, the president should ask everyone to pitch in. If the need is national, the solution should be national—and that includes all of us.

But that's not how Mr. Obama governs. We learned during the 2008 campaign that he believes in spreading the wealth around. And recently we learned he doesn't believe that successful people made it on their own. Without the government, the president tells us, job creators and entrepreneurs would not be able to make it in America.

It's really the other way around. Without job creators and the successful, the government wouldn't have any money. So next time Mr. Obama meets someone in the top 1% or even the top 20%, instead of saying they're not paying their fair share, he should simply say thank you.

You wouldn't know this from President Obama's rhetoric, but our tax system, according to a recent report by the Congressional Budget Office (CBO), is incredibly progressive. Consider: The top 1% of income earners pay an average federal tax rate of 28.9%. (See the nearby table.) The average federal tax rate on the top 20% is 23.2%. The 20% of taxpayers earning between $50,100 and $73,999 pay an average 15.1%, and so on down the line. The CBO report includes payroll as well as income taxes paid.

There's also another way of looking at fairness, and that's the tax burden. Here, consider the top 20% of income earners (over $74,000). They make 50% of the nation's income but pay nearly 70% of all federal taxes.

Yet President Obama says that "for some time now, when compared to the middle class," the wealthy "haven't been asked to do their fair share."

He's right that the system isn't fair, but not because the top 1% pay too little. It is because they pay too much.

Mr. Obama has said that some wealthy employers pay a lower tax rate than their secretaries. True, some are able to lower their effective federal tax rate by giving millions to charity. Or because they derive much of their income as capital gains or from tax-free municipal bonds.

But middle- and low-income Americans who do not invest also pay lower rates thanks to the deductions they receive, such as a $1,000 per child tax credit (which phases out for couples who make more than $110,000), or the Earned Income Tax Credit, which no one making more than $50,000 is supposed to receive.

The CBO report ("The Distribution of Household Income and Federal Taxes, 2008 and 2009") covers the years 1979-2009. It makes plain that the impression conveyed by the president about what upper-income Americans pay in taxes does not hold up to scrutiny.

First of all, the share of taxes paid by the top 20% has gone up over the last 30 years, while the share of taxes paid by everyone else has gone down. It has gone up despite the tax cuts enacted by President Clinton in 1997 and by President Bush in 2001 and 2003. But that makes no difference to the president. The only group of taxpayers he calls on to "sacrifice" are those already doing all the tax sacrificing.

The top 20% in 1979 made 44.9% of the nation's income and paid 55.3% of all federal taxes. Thirty years later, the top 20% made 50.8% of the nation's income and their share of federal taxes paid had jumped to 67.9%.

Getty Images

Meanwhile, the federal tax burden on middle- and lower-income earners is lighter. In 1979, the bottom 20% paid barely any taxes at all, just 2.1%. Now their share of taxes is a minuscule 0.3%. The burden on the middle-income earners ($34,900 to $50,100) has dropped too. In 1979, they paid 13.6% of all federal taxes; in 2009 they paid 9.4%.

One reason our country is so divided is because the president keeps dividing us. If taxes need to be raised to fight a war or fund a cause, the president should ask everyone to pitch in. If the need is national, the solution should be national—and that includes all of us.

But that's not how Mr. Obama governs. We learned during the 2008 campaign that he believes in spreading the wealth around. And recently we learned he doesn't believe that successful people made it on their own. Without the government, the president tells us, job creators and entrepreneurs would not be able to make it in America.

It's really the other way around. Without job creators and the successful, the government wouldn't have any money. So next time Mr. Obama meets someone in the top 1% or even the top 20%, instead of saying they're not paying their fair share, he should simply say thank you.

Subscribe to:

Posts (Atom)