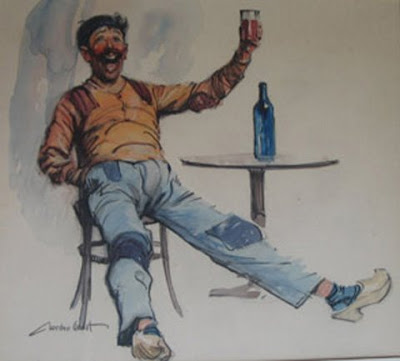

SPENDING LIKE A DRUNKEN SAILOR

by Howard Ruff

History tells us that the first paper currencies were notes payable(redeemable) in gold or silver, or, mere warehouse receipts for storedgold. Over the years, it became obvious that it was easier to simply exchange the receipts after a transaction than go to the warehouse withthe receipts to get the gold and silver. The receipts became currency incommon usage, and the people began to think of the receipts (currency) asmoney all by itself, completely detached from any stored gold.Then, as governments began to buy votes or finance wars, they yielded tothe temptation to simply print more "receipts" than there was gold andsilver to back them up (who would know?), each time triggering more andmore inflation. The foundation for inflationary tactics was laid inAmerica when Roosevelt created the New Deal, then Lyndon Johnson financedthe War on Poverty and the Vietnam War at the same time (guns and butter),and the printing presses have had to step up the pace ever since. (Povertywon and so did North Vietnam, but that's another story.)The process of currency destruction has been accelerating, with advancespunctuated by retreats, since the '30s. Throughout history, this has beenthe case over and over again ever since the birth of paper money. Thecritical moment in this era came when Nixon "closed the gold window" (nolonger allowing dollars to be exchanged for gold or silver) at the FederalReserve. This move finally admitted America's irresponsible reality andpermanently detached the paper dollars from gold or silver, and the moneyprinters were off to the races. Then Uncle Sam hammered the last nail intothe coffin in 1965 by no longer making 90 percent silver coins. In the last ten years, the Fed has manufactured trillions of dollars outof nothing at the fastest pace in history by far, and it's nowaccelerating. The Fed has then loaned the dollars into circulation, orgiven them to politicians to spend. Since then, Congress has been spendinglike a drunken sailor. (The difference between Congress and a drunkensailor? A drunken sailor spends his own money!) This money expansion nowdwarfs the monetary explosion which led to that historic metals bullmarket in the '70s. Gold and silver have been rising recently in response,driving gold from $252 to $560, and silver from $4 to more than $15.50.It's hard for me to exaggerate or overstate what is happening. Economistscall this monetary-expansion process "inflation." It really should becalled "dilution," that is, dilution of the money supply, and consequentlyits value. Inevitably, this sooner or later causes rising consumer prices,which laymen, and the media, and even Wall Street, will still mistakenlycall "inflation." Calling rising prices "inflation" is like callingfalling trees "hurricanes!" Or as Jim Dines says, "it's like calling wetsidewalks rain.When will the masses catch on to this steadily progressing fact of life?Gold and silver prices are the true measure of public awareness. Sooner orlater, awareness reaches critical mass, and the metals go through thestratosphere.One early-warning harbinger of inflation is the dollar losing exchangevalue against foreign currencies, which began in earnest in 2002 and 2003.The dollar, with fits and starts, has been in a long-term bear marketagainst other currencies for a few years. A falling dollar isinflationary, as it takes more and more dollars to buy the increasingamounts of foreign-produced goods we are now buying. Wal-Mart's soaringsales are a telling indicator, as they are Asia's biggest customer. Goldand oil are quoted in dollars, so up they go. And now the metals arerising, not just against the dollar, but against nearly all currencies asthe metals grow in strength, and virtually every country on Earth isinflating its currency. It's actually more accurate to say the dollar isfalling in relation to gold, than to say gold is rising in relation to thedollarThe falling dollar-exchange value explains the early strength of themetals, and there is a lot more to come, as we continue to flood theinternational money markets with dollars. We now don't even have to printthem. This is the age of cyber-money, when less than five percent of thedollars are minted or printed, and most are only computer entries atbanks. We don't even know how many dollars there are!There is a serious supply problem. 22 years of low or falling gold andsilver prices gave us a drop in production and exploration of epicproportions, as miners pulled in their horns to preserve their capital.This set the scene for a great supply/demand problem. Now that prices arehigh enough to make gold and silver mining profitable, it will take aslong as seven to ten years to develop new mining and production, andfalling supply and rising demand have made higher prices inevitable forthe imminent future. Also, remember that most of the easy shallow silver has been mined overthe centuries, even with primitive methods, and the silver deposits arestill being depleted. For example, during the Roman millennium, silvercoins were used for currency, so the Romans, after they conquered Spain,expropriated the large Spanish silver mines so they could use the silverfor their own coins. They soon depleted the shallow mines, so they beganto counterfeit their own currency, mixing silver with base metals, makingthe coins thinner, or clipping the corners.As the mines were further depleted, it got worse and worse until thecitizens began to distrust the currency, demanding more and more of it inexchange for their goods and services, causing a great inflation. Soon,the far-flung Roman Legions refused to accept the less-and-less valuablecoins at face value for their pay, and began deserting in droves. Thisinflation was one of the root causes of the fall of the Roman Empire-allbecause they counterfeited the currency.Now, silver industrial applications have soared into the thousands, andthere are few satisfactory substitutes in sight. New silver mines aregetting harder and more expensive to find, and supply is falling fartherand farther short of demand. One expert claims that the deeper you go intothe ground, the less silver there is.Both metals are far rarer than most people know. All the gold ever minedsince the dawn of history, including that in central banks, gold fillingsand sunken shipwrecks in the Caribbean, would cover a football field aboutfour feet deep. And, demand is now leaping past new supplies.China and India are enjoying a historic burst of capitalist prosperity,and their booming new middle class is enthusiastically buying gold andsilver jewelry, creating soaring new demand! Silver use is incredible andrising! The thousands of irreplaceable silver industrial uses, partiallyaccounts for the shrinking inventory. Government silver warehouses are now all empty, and COMEX futures positions, much of which must be coveredeventually by deliveries or purchases, are estimated to be equal to orgreater than all new production! Silver is the poor man's gold. Think of gold as large denomination money,and silver as small change. A one-ounce gold coin now costs only about $650, and you can buy a roll of pre-1965, 90 percent-silver dimes forclose to $50 a roll. Partly because it is so much cheaper that the potential buying pool is much larger, and industrial use is so muchgreater, silver will be more profitable than gold by at least 100percent!And, there's more to come.

No comments:

Post a Comment