The economy that debt built

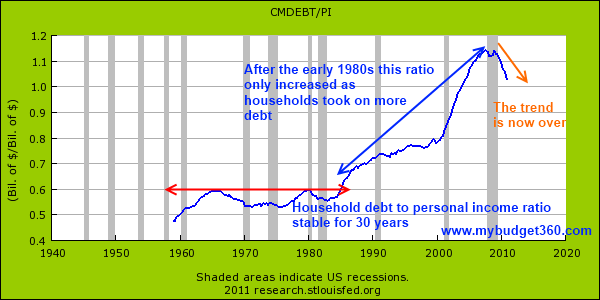

I wanted to examine the growth of personal income in relation to household debt. If we setup a ratio between the two we see that from the 1950s to the early 1980s the ratio was rather stable. Even while debt went up, so did incomes at a relative level. This all changed in the early 1980s:

Just like a person can go out and buy a McMansion with a giant mortgage, lease a European luxury car, and go into $100,000 of student loan debt the good times are felt only shortly. The bill eventually does come and it is coming in full to the American public. Yet the middle class only expanded because of access to debt. So as this access is shunted the American middle class has now faced over a decade of lost returns in wages. No growth. The reason so many people are losing their homes is because they simply do not have the income to sustain their purchases of the years when debt was handed out like candy. The big banks still have access to this debt machine courtesy of the Federal Reserve. Yet the middle class is now being thrown to the wolves to support the too big to fail. Why doesn’t the media after four years examine deeply what we have gotten for the trillions of dollars thrown at the banking sector?

Stock distributions

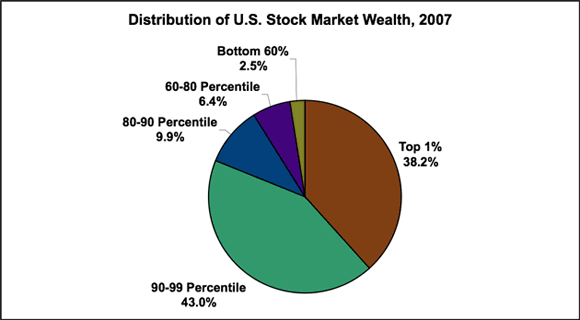

Stock wealth is a good indicator of wealth in a nation. Someone can own a nice home, a fancy car, and all the goodies in their home but have zero wealth and even a negative net worth. But with 1 out of 3 Americans with no savings and 50 percent of Americans unable to come up with $2,000 in the next 30 days, very few can be said to have wealth. At this point it is useful to examine who owns the stocks in America:

Source: Economic Policy Institute

The top 1 percent in our country control over 38 percent of all stock wealth. The top 10 percent control over 81 percent of all stock wealth. In the end, stocks are something the middle class by definition do not participate in with any significant vigor. For those with a sizeable portfolio you are in the upper-class simply by definition. At some point people have lost perspective. There was a study conducted recently that found for millionaires to feel wealthy they need $7.5 million. Have these people lost perspective that 45 million Americans are on food stamps? Or what about the 23 million underemployed in the country? Or the fact that half of the country couldn’t come up with $2,000 in 30 days. This group has bought into the Wall Street propaganda machine of the poor financial CEO only making enough to fuel 20 yachts. So yes, the bailouts were justified in their mind.

The gap only grows

What made our country grow from the 1950s to 1960s in a healthy manner was a shared growth in real personal income without relying too heavily on debt. This was shared prosperity. Nothing like that has occurred over time. The data is what it is and the gap is obviously present unless you choose to ignore it:

Again you can go back to the 1980s to see the start in this income divergence. Since that time the bottom 80 percent has been sacrificed while the top 1 percent has seen accelerated growth of their wealth. Now what exactly happened over this time? First there was massive financial de-regulation. This allowed for the junk bonds of the 1980s, the S&L Crisis, the tech bubble, and finally our historic housing bubble. Yet while the middle class got taken for a ride after each bubble burst, the financial sector simply received a bailout each time. The returns from government bailouts are guaranteed so this is why Washington D.C. is filled with banking lobbyists. It is the best return you can get when you can steal the taxpayer blind.

The wealth inequality in our nation is a consequence of this de-regulated two-tier system of crony capitalism. As the middle class has seen their wealth and jobs being stripped from their overworked hands, the top 1 percent has enriched themselves with every subsequent bailout. As we all know through the parroted financial media, stocks over the long-run return 8 percent. Yet what if you have no savings as many Americans do? What about the fact that this does not factor in the reality of selection bias when all we see is companies that continue to survive (i.e., no failed companies in the S&P 500 right now). So you see what you want to see. And the most important key ingredient is government backed taxpayer bailouts for the ultra wealthy. They can’t lose but the charts above show that this has come at the expense of the middle class. No one is begrudging say a Netflix that is providing an actual service and making fantastic sums of money. Good for them. But what we have is the financial sector simply looting the wealth of middle class Americans and providing no service other than stealing their money for bailouts. Then you have the too big to fail making billions on onerous fees like overdrafts which directly hurt the poor the most.

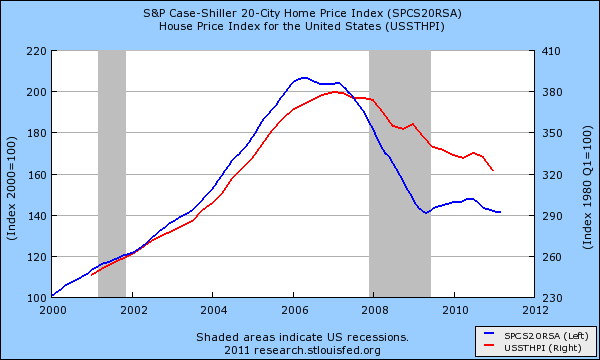

Americans that do have a tiny bit of wealth have it in their homes. Yet as we all know the housing market isn’t exactly doing that well right now:

Didn’t the bailouts have a premise of helping middle class homeowners? Of course not. The money has been diverted for banks to speculate in global stock markets while they completely ignored the housing market. The new world of crony capitalism, where the connected win even if they lose.

No comments:

Post a Comment