Watching the financial channels yesterday, I could not tell you how many times the word “recovery” was used. Sure, the stock market is up, but that is compliments of the Federal Reserve. Since the 2008 financial meltdown, we’ve had a money printing extravaganza. There was QE1, QE2, Operation Twist, dollar swaps with Europe and 0% interest rates (on a key rate) through 2014. Of course the stock market is up, it loves free money. Wall Street may have recovered, but Main Street is still in the dumper. (Actually, Wall Street has just broken even since the 57% plunge it took up to March of 2009.) Professional commodities trader Dan Norcini said, this week, on his blog, “. . . the FED IS TERRIFIED OF RISING INTEREST RATES.” Norcini explains, “. . . the US federal debt is at banana republic levels and any, I repeat, any rise in interest rates, will suck more of the incoming federal revenue into servicing the cost of this debt (paying the interest on it), leaving less for the spendthrift class to buy votes with. Bernanke and company cannot afford to have a stock market that stops moving higher because if and when it did, the entire facade of an economy on the mend would come crashing down with it.” (Click here to read the complete Trader Dan post.)

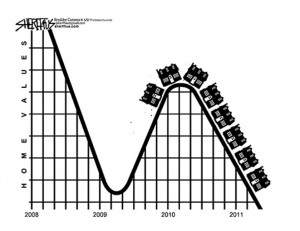

Watching the financial channels yesterday, I could not tell you how many times the word “recovery” was used. Sure, the stock market is up, but that is compliments of the Federal Reserve. Since the 2008 financial meltdown, we’ve had a money printing extravaganza. There was QE1, QE2, Operation Twist, dollar swaps with Europe and 0% interest rates (on a key rate) through 2014. Of course the stock market is up, it loves free money. Wall Street may have recovered, but Main Street is still in the dumper. (Actually, Wall Street has just broken even since the 57% plunge it took up to March of 2009.) Professional commodities trader Dan Norcini said, this week, on his blog, “. . . the FED IS TERRIFIED OF RISING INTEREST RATES.” Norcini explains, “. . . the US federal debt is at banana republic levels and any, I repeat, any rise in interest rates, will suck more of the incoming federal revenue into servicing the cost of this debt (paying the interest on it), leaving less for the spendthrift class to buy votes with. Bernanke and company cannot afford to have a stock market that stops moving higher because if and when it did, the entire facade of an economy on the mend would come crashing down with it.” (Click here to read the complete Trader Dan post.) I see no recovery for people on Main Street as far as housing is concerned, and neither does economist John Williams of Shadowstats.com. His latest report, last week, focused solely on housing and construction. The first line in his report says it all, “The construction industry remains distressed in the extreme, clobbered by collapsing broad economic activity from 2006 into 2009 and by three subsequent years (and counting) of no recovery—just economic stagnation.” (Click here to go to the shadowstats.com home page.) You want to see what construction spending on payrolls looks like on a chart? Here’s the ugly picture, compliments of Shadowstats.com.

Williams says construction payrolls haven’t been this depressed since “June of 1996.” That’s nearly a 16 year low! It’s not just construction jobs that have taken a hit, even Fed Chief Ben Bernanke admitted the job market in general is weak. Monday, USA Today reported Bernanke said, “Despite the recent improvement, the job market remains far from normal,” Bernanke said. “The number of people working and total hours worked are still significantly below pre-crisis peaks.” (Click here for more from USA Today.) If unemployment were calculated the way Bureau of Labor Statistics did it in 1994 and earlier, the true unemployment/underemployment rate would top 22% according to Shadowstats.com.

Bernanke said, last night, he’s now worried about fuel prices slowing the so-called recovery. He told ABC News, “They’re obviously a hardship for lots of people. It must be awfully frustrating to get a small raise at work and then have it all eaten by a higher cost of commuting,” he said. Bernanke said higher gas prices may cause inflation to be “a little bit higher” in the next few months and take a bite out of consumer spending, leading to “a hit on growth.” (Click here for the complete ABC story.)

Bernanke thinks gas prices may fuel inflation? Silly me, I thought it was all the money printing to prop up the banks and stock market that caused inflation. At any rate, Dr. Bernanke better hope IMF Chief Christine Lagarde’s warning, last week, of a possible 30% spike in oil prices doesn’t come true. Lagarde was lamenting the standoff with the West over Iran’s nuclear program when she said, “A sudden and brutal rise in the price of oil from Brent crude’s current levels of $125 a barrel would have serious consequences on the global economy until other oil-exporting nations were able to bridge the gap.” (Click here for more from France24.com.)

If gasoline prices did spike 30%, that would put the national average well above $5 for a gallon of gas. Even if war with Iran is averted, many experts think gas prices will rise anyway, right along with the summer driving season. But don’t worry, Bernanke doesn’t see “anything that’s going to stall the recovery,” even though housing says it’s a hoax.

No comments:

Post a Comment