The shadow inflation through the US dollar

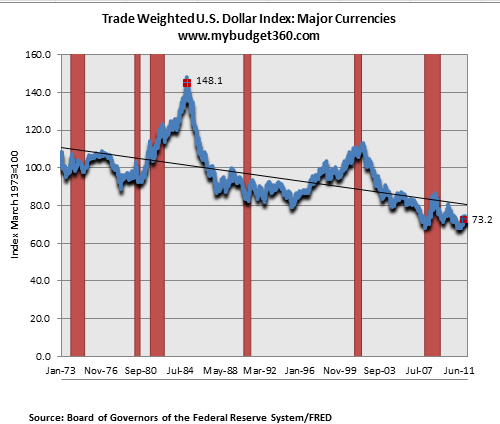

The Fed has been on a mission to crush the US dollar. This isn’t some kind of hidden agenda. It is right out in the open:

The US dollar has lost 50 percent of its purchasing power since 1985. What has made the pain much more real is that most Americans have seen a decline in their wages and their overall net worth. The above is a logical extension of the Federal Reserve digitally creating money out of thin air. Today debt equals money. If you keep increasing money (aka debt) what do you think will happen? The Fed balance sheet now stands above $2.8 trillion in questionable debt assets. The decline in the US dollar is simply what occurs when you spend way more than you earn. Our $15 trillion national debt is a testament to that.

Since the average household doesn’t have the ability to print money out of thin air or create debt instruments with a few keystrokes, they typically pick up the bill on this shell game. There literally is no free lunch when it comes to inflation. Take a look at this:

Nabisco’s offers a Fresh Stacks package that contains 15 percent fewer crackers than the previous package listed on the bottom. If you got 15 percent less for basically the same price, would you not call this a price rise? Of course the BLS measures a basket of goods and doesn’t really pick up these tiny changes. Or take for example cans of tuna:

Chicken of the Sea now typically comes in 5-ounce cans versus the traditional 6-ounce cans. This is over a 16 percent reduction for the same price. You can understand why the average household even though they may spend the same or more at the grocery store is really getting a good amount less for their dollar. Well of course, the US dollar has lost 50 percent of its purchasing power since 1985.

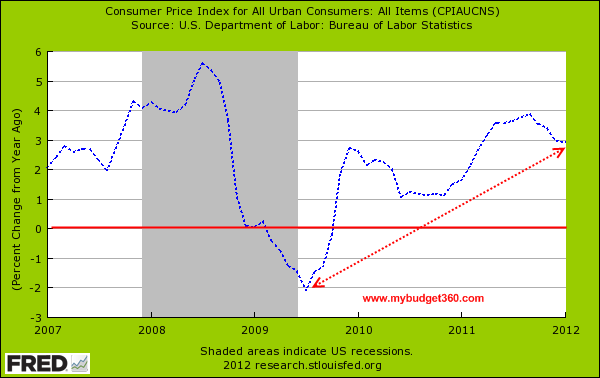

The supply chain is enormous and the rising cost of fuel is typically passed all the way down to the consumer. Since the average American makes $25,000 a year and many are now frequenting dollar stores for their shopping, companies realize they can only hike prices up by so much. Instead companies have been savvier about passing costs by reshaping their packaging. So the cost of the item may remain but the true cost has actually gone up. A shadow inflation because the overall inflation rate seems moderate:

Much of the bout of deflation above came through the massive amount of debt destruction during the height of the financial crisis. Given that debt equals money in our system, the money supply contracted heavily during this period. Now however, the Fed is holding on to trillions of dollars of questionable assets while households actually deleverage. In other words, banks can ride out the storm on the back of the public while households need to deal with the cost of bailing out the system.

Smaller packaging for the same cost is part of the shadow inflation that is being experienced by US households. Don’t expect this to be on the nightly news or the fact that 46,000,000 Americans are currently on food stamps. Everything is simply fine and dandy even though you are paying a whole lot more for a whole lot less.

No comments:

Post a Comment