Financially fragile

This is a recent survey and the implications are troubling:

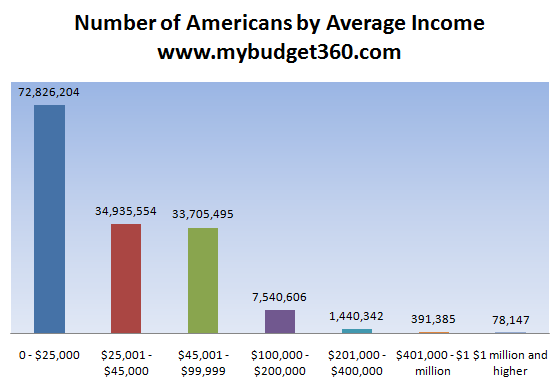

“(WSJ) The survey asked a simple question, “If you were to face a $2,000 unexpected expense in the next month, how would you get the funds you need?” In the U.S., 24.9% of respondents reported being certainly able, 25.1% probably able, 22.2% probably unable and 27.9% certainly unable. The $2,000 figure “reflects the order of magnitude of the cost of an unanticipated major car repair, a large copayment on a medical expense, legal expenses, or a home repair,” the authors write. On a more concrete basis, the authors cite $2,000 as the cost of an auto transmission replacement and research that reported low-income families claim to need about $1500 in savings for emergencies.”The above data fits into the mold that average Americans are simply falling behind the elusive curve. The average per capita income for the United States is $25,000. People get somewhat surprised when they hear this figure because it seems low for the most wealthy nation in the world. We invented Cribs and Lifestyles of the Rich and Famous for crying out loud. Yet most that are surprised do not live in the bottom half and keep in mind many of these families are in the two income trap. Meaning both spouses have to work in order to keep things moving financially:

Source: Social Security

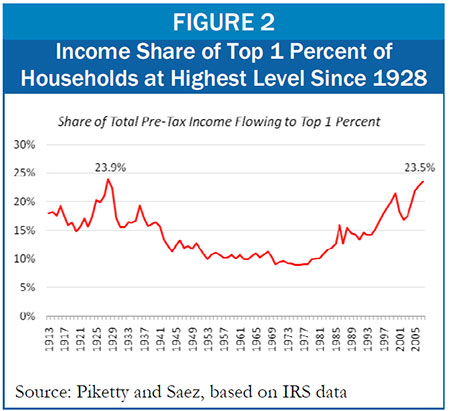

This brings up the question of recovery once again. If half of Americans are teetering on financial disasters and all it would take is $2,000 in unexpected expenses, what do we really mean by a middle class lifestyle? The last two years have not been supportive to the working people of America. The large gains have gone directly to the top 1 percent:

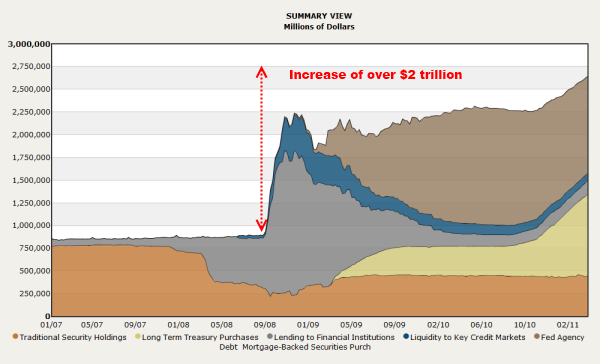

Even with these kinds of gains the income is going to the wealthiest in our country because the current bailouts have rewarded those with large financial positions in stocks:

Now part of this inequality is merely the widespread pillaging of Wall Street on the American public. The banking bailouts that occurred to an industry that turned housing, the largest net worth item for average Americans, into a commodity to be traded and exploited. Most Americans derive their net worth from home values, not stock market gains. So the 100 percent run-up of the stock market has done very little for the majority in the country (this can be seen by the Gallup 19 percent underemployment figure). Do we think that those that are $2,000 away from financial ruin are loading up on stocks in their retirement accounts? They are simply getting by. This is why wealth inequality is now at levels last seen since the Great Depression:

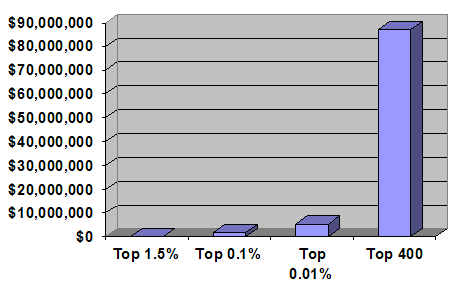

The rich will get richer

An interesting report from Deloitte came out showing that over the next decade the rich in the world will simply get richer by using the current system that pillages the working classes around the globe:

Source: Zero Hedge

“(Zero Hedge) A new study by Deloitte confirms everyone’s worst fear (and every millionaire’s wettest dream): the wealth amassed by millionaire households is set to increase by more than 100% over the next 9 years. From a total of $92 trillion held by the world’s richest in 2011, by 2020 the world’s millionaire households will possess $202 trillion, or roughly 4 times current global GDP. Even though much of move up is attributed to the wealth surge in the developing world, the biggest beneficiary is, you guessed it, the United States where the millionaires (those with net wealth of at least $1 million), who currently account for $38.6 trillion of total wealth, will see their assets increased by 225% to $87.1 trillion! And while a comparable study of how much wealth the lower and middle classes are set to lose over the next decade, we are confident that it will be roughly comparable…inversely. So if anyone harbored any illusions that the current status quo was about anything but the rich getting richer, all those can be promptly swiped aside.”The model of exploiting bubbles and financially ruining working and middle class families has worked so well that it is being applied globally by the wealthy and financially connected class. Again the question becomes what do we mean by recovery? Is it a recovery if the majority of American families are left in a financially destitute situation just to bailout too big to fail financial institutions to protect the wealth of the top one percent? Keep in mind these are the individuals that have set fire to the economy and have put a match to the home equity of most Americans. This is the system that is being protected but not for the majority.

Job growth in low paying fields

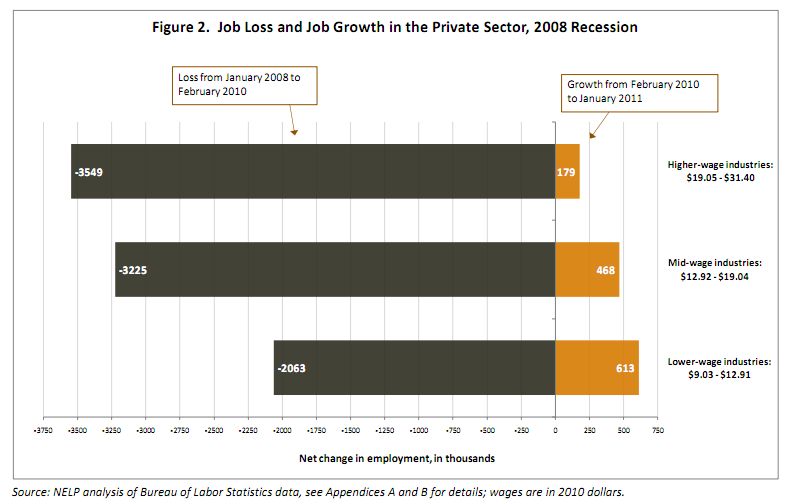

We would expect that a recovery would occur with good paying jobs dominating the new workforce. That is not the case:

Source: NELP

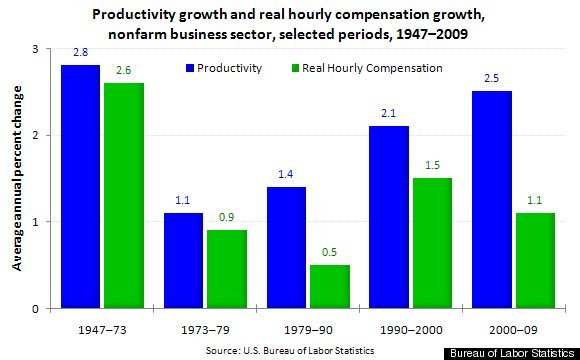

As you can see from the chart above most of the jobs being added in the recovery are from lower paying job sectors. The middle class is seeing more and more strains being placed on their monthly budgets. Trading good blue collar jobs in say building cars into burger flipping McDonald’s jobs. Anyone that has followed the trends closely realizes that seeing 50 percent of Americans only $2,000 away from major financial issues is no surprise. In fact 1 out of 3 Americans doesn’t even have a penny to their name! This is the issue at hand and while too big to fail banks leverage the Federal Reserve for zero percent loans and a place to trash toxic waste loans, many Americans do not even share in their rising productivity:

The above is the dumping ground for the big financial elite. Yet working and middle class Americans keep increasing their productivity with no rewards:

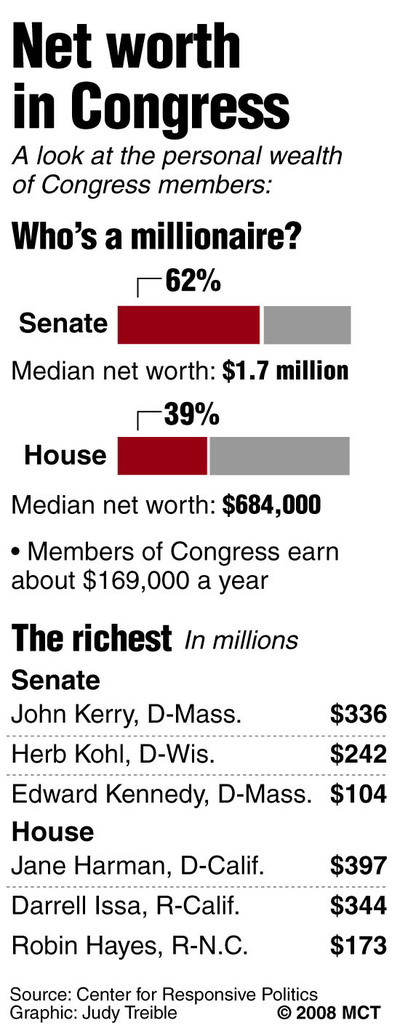

No wonder why profits are up and wages are down. Less is being given to those creating the new gains under the guise that things are financially tight. Tight for who? The CEO of JP Morgan that makes 800+ times the median household income of Americans for foreclosing on millions and gambling in speculative investments that hurt the real economy? If you wonder why nothing is done in Washington D.C. the vast majority of representatives support the elite class because they are part of it:

Until people start making these wider connections we will keep rearranging the deck chairs on the Titanic and by 2020 the wealthy will be even wealthier and the middle class will be a shell of what it once was in the United States. This is the new recovery according to the large financial interest that controls our government.

No comments:

Post a Comment