Where is the debt flowing?

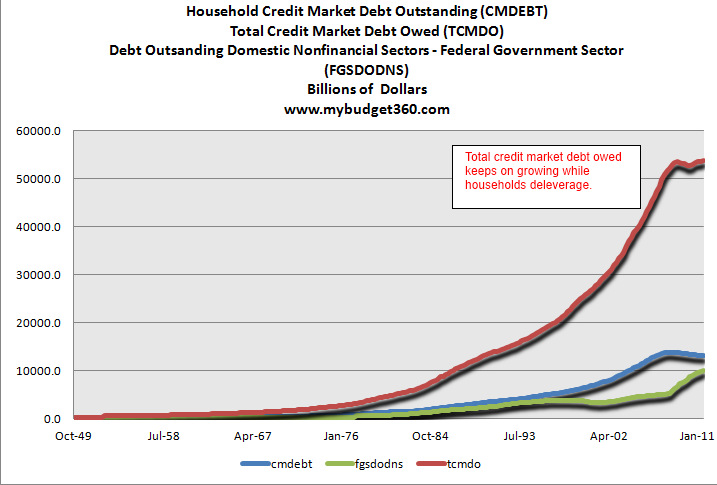

The government is largely a proxy for big financial interests. This is how trillions of dollars were inserted into the Fed balance sheet with absolutely no oversight. Since the recession hit households have been deleveraging via foreclosures, bankruptcies, student loan defaults, and auto repossessions. Yet as the household debt sector contracted the total credit market continued growing:

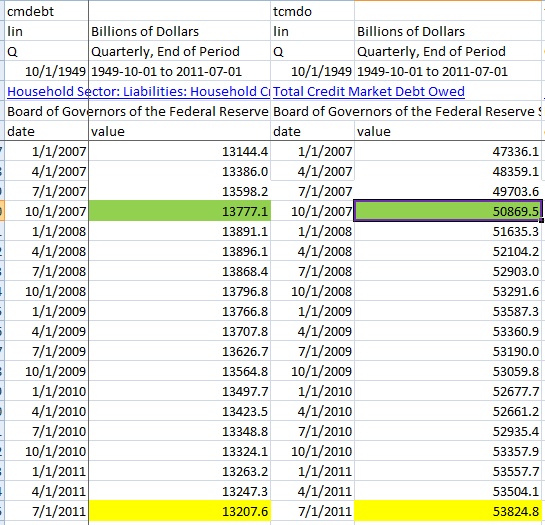

The chart is rather clear. Total US household debt stands at roughly $560 billion below the amount in October of 2007. Keep in mind we have been adding more to our population so this is part of the austerity that is forced onto the public. Yet you will also notice that total credit market debt grew by nearly $3 trillion:

A big part of this is debt owed by the government ballooning by $5 trillion from October of 2007 to the end of 2011. The party of the Congress or President matters not since much of this money has been used to keep the system in place for the financial sector and came about under both Republicans and Democrats. So while US households have faced the harsh reality of deleveraging the financial sector has continued to party along by expanding total debt in the markets to bailout their special pet projects. The Fed balance sheet ballooned to nearly $3 trillion and is still there with debt that we have little insight into. Consider it a holding ground for toxic mortgages and failed commercial real estate loans.

How much debt is too much?

There is no manual showing us at what point an economy reaches too much debt. A famous economist once quipped that too much debt is reached when the market believes too much debt has been reached. In regards to US households, the recent snag in debt growth comes after half a century of pure growth. It seems that the peak was reached when US household debt equaled total annual GDP. Yet total credit market debt continues to expand.

It seems rather odd that the $53 trillion in total debt will never be fully paid off. So then what is the end game? Central banks have a preference of inflation since it gives them more tools to manage the bubble’s pop. Yet winners and losers are being chosen here. The financial sector continues to garner more power at the expense of the working and middle class.

“The political class now spends virtually all their time raising money from large donors so they can then spend money to show up on mainstream media shows that are owned by these same donors.”You wouldn’t know it, but we have 46,000,000 Americans one food assistance check away from not eating. How is that for perspective? Is any candidate talking about the $53 trillion in debt or the 46,000,000 Americans on food assistance?

The problem with the current debt market solutions is that much of the money has gone to the financial sector with no teeth to restructure. The burden is being squeezed out from households yet the real meat is in the bigger debt markets. Then again, we simply keep on pretending that somehow this debt will be paid off at some point in someone’s generation. It certainly will not happen anytime soon.

No comments:

Post a Comment