Where life had no value, death, sometimes, had its price. That is why the bounty killers appeared. - For a Few Dollars More

“Tell me, isn’t a sheriff supposed to be courageous, loyal and, above all, honest?” - Man with No Name – For a Few Dollars More

“Tell me, isn’t a sheriff supposed to be courageous, loyal and, above all, honest?” - Man with No Name – For a Few Dollars More

Whenever I get an idea for an article I plan to keep it short and sweet. But it never seems to work out that way. Once I start typing, the articles tend to grow exponentially. It happened again with my attempt to make sense of how the United States of America managed to screw our finances up so badly, that an epic collapse is within view to people with their eyes open to facts and the truth. You don’t end up in the predicament we find ourselves in today due to a couple minor mistakes over a short time frame. It took thousands of horrible choices, colossal doses of delusion, a heaping of stupidity, and a mountain of denial over decades to put us on the brink of economic collapse. An unholy amalgamation of demographics, fiat currency, debt, taxes, power and greed have led us to this point. Next we experience collapse, revolution and ultimately, retribution.

Since I’ve identified four major rationales for our impending doom, I’ve decided to write a four part series that can be read in small doses, rather than one enormous article. I don’t want anyone to miss tonight’s episode of Dancing With the Stars, get distracted from the Royal Wedding preparations, or skip the best reality TV show ever – Ben Bernanke’s press conference, while reading an 8,000 word article about the end of America. The four part series will have a Clint Eastwood theme. For a Few Dollars More will address the Baby Boomer impact on America’s decline. A Fistful of Dollars will examine how the creation of the Federal Reserve and the income tax in 1913 set us on a path to ruin. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

Over the last few weeks there seems to be consensus among many financial bloggers, whose credibility is far more trustworthy than the corporate mainstream media, that the country is teetering on the verge of economic collapse due to the complete capture of the government, financial, regulatory, and media by a small group of oligarchs. They have also been described as the super rich, plutarchs, ruling elite, and scum sucking leeches. The bloggers that I have the utmost respect for, including Jesse, Charles Hugh Smith, Mike Shedlock, Yves Smith and Gonzalo Lira have all come to the logical conclusion the horrific economic situation of the country is a direct result of the greed, corruption, fraud, and plundering by a powerful connected group of rich financiers operating without fear of being brought to justice by the authorities.

While pondering the ruminations of these dedicated truth tellers, I was reminded of the Clint Eastwood Spaghetti Western For a Few Dollars More. The quotes above are representative of living in the USA today. There are supposed to be courageous, loyal and honest sheriffs that protect the citizens from crime, corruption and evil doers. But, just as we saw in the Old West of Clint Eastwood movies, the sheriffs are always corrupt and bought off by the evil cattle barons. In a world where life has no value and you can’t rely on law enforcement to protect your interests, the citizens eventually will need to turn to bounty hunters to take care of the bad guys. The bounty hunters of truth reside on the internet. They reside at Zero Hedge, Jesse’s Café Americain, Of Two Minds, Mish, Chris Martenson, and dozens of other anarchist websites. When you can’t trust your government, your bankers, your church, your media, or mega-corporate CEOs, you need to seek the truth where it can be found. The insightful bloggers who courageously print the truth on a daily basis have unanimously concluded that a small band of powerful elite have accumulated undue influence and control over this country, having brought it to the verge of economic collapse. How did this happen? Who is responsible? Why were they permitted to gain this power?

Whenever I direct any blame for our economic woes towards the Baby Boom generation they react as expected. They blame the GI Generation for creating the welfare state. They declare that Generation X and the Millenials are just as greedy and self centered as the Boomers. Boomers are great at blaming, ridiculing and acting pompously, while taking no responsibility for their actions and more importantly their inaction. This generation cannot avoid their responsibility for the state of affairs. They like to take credit for their stand against the Vietnam War and their protests against the man during the 1960s. They don’t like to take credit for turning into materialistic, greedy, selfish, short-term focused bastards. When a generation of 76 million people decides to go in a particular direction, the country will go in that direction. While blaming FDR and the GIs who stormed the beaches of Normandy for creating the unfunded Social Security and Medicare liabilities, the Boomers have been voting since the mid-1960s and have been in control of corporate America and the levers of government since the early 1980s.

The U.S. Congress is dominated by Baby Boomers today and has been dominated by this generation since the 1990s. The Senate has 60 Boomers out of 100, while the House of Representatives has 254 Boomers out of 435 members. Boomers occupied the White House from 1992 through 2008. They have had the political power and control of the agenda for two decades and have failed miserably. Rather than do what was best for the country for the long-term, they took the expedient, easy, vote getting route. Promise more than you could ever deliver and let future generations worry about the consequences. Not one true noble statesman has arisen from this generation of myopic, self centered “Me Generation” political hacks. Even as the country nears the precipice, they continue to address the great issues of the day with talking points supplied by other Baby Boomer PR maggots from Park Avenue. These weasels care not for the country, but worry only about poll numbers and the next election cycle. An apathetic public, dominated by the Baby Boom generation, has the attention span of a gnat. As long as they can make the lease payment on their Escalade, use one of their 15 credit cards at the Mall, be entertained by 600 cable TV stations, play with the latest iSomething, live in their McMansion for two years without making a mortgage payment and consume massive quantities of fast food, then any thoughts of future generations or civic duty are unnecessary. Live for today has been the rallying cry for the Boomer generation. Pot was their drug during the 1960s. Debt has been their drug since 1980.

The drug (debt) dealer for the Baby Boom generation has been the Wall Street mega-banks, coincidentally, run by Boomers. The entire corrupt financial industry is being run by Boomers. The CEOs, CFOs, and the thousands of Harvard MBA VPs that created the fraudulent derivative scheme to bilk billions from clueless municipalities, pension funds and American taxpayers are all Boomers. It is no coincidence that the great debt delusion began in the early 1980’s. Jim Kunstler captured the essence of Boomer transformation:

“The Baby Boomers came back from the land, clipped their pony tails, discovered venture capital, real estate investment trusts, securitization of “consumer” debt, and the Hamptons. Greed was good.”

The Boomer CEO hall of scam has been built on the brilliance and financial acumen of Lloyd (god’s work) Blankfein, Charlie (keep dancing) Prince, Jamie (friend of Obama) Dimon, and the king of the Boomers, Hank (the system is sound) Paulson. These mainstays of crony capitalism led the Boomer charge of greed, greed and more greed. The Baby Boomer generation has been the proverbial pig in a python working its way through the decades as presented below. By 1985, Boomers had entered the work force in full force with the entire generation between the ages of 25 and 42. It will be a great day when the python craps this pig of a generation out the other end.

It is not a coincidence the National Debt growth has far outstripped GDP growth since 1980. Boomers had been spoiled their whole lives and felt they deserved the goodies today while passing the bill to future generations. They voted for politicians who promised them more benefits, more programs, more subsidies, more tax breaks, more military adventures, and more pleasure. And this was “paid for” with more debt. Thirty five years of government debt declining as a percentage of GDP was reversed over the next thirty years starting in 1980, pushing it past the 90% tipping point in the last year. The country is over-indebted to the tune of $9 trillion on a current basis and $100 trillion on a long term accrual basis.

There is no better picture of Boomer decadence and myopia than an historical view of the national savings rate. The parents of the Boomers understood the meaning of sacrifice and investing in the future of the country. During World War II they bought US War Bonds to support the cause. From 1950 through 1985, the savings rate consistently ranged between 7% and 12%. Americans had this odd notion that if you saved more than you spent, you actually got ahead in life. Excess savings were used to invest in new plants and equipment that were used to produce goods and employ more Americans. By 1985, the Boomers considered these notions as quaint and old fashioned. The savings rate methodically declined until it went negative in 2006, just prior to the worldwide financial conflagration. Our inspirational Boomer president George (Mission Accomplished) Bush while waging two wars of choice, asked for the ultimate sacrifice from the Boomers. He solemnly urged them to buy a GM SUV with $0 down and 0% interest for 7 years, so we could defeat the terrorists. The Boomers who ran GMAC were more than happy to make loans to people with no income so they could “purchase” a $40,000 ostentatious gas guzzling hog. They were doing their patriotic duty for the good of the nation. It brings a tear to my eye just thinking about it.

The Boomers not only heeded George’s call, but they did him proud by buying 8,000 sq ft McMansions with $0 down and negative amortization ARMs. Luckily, the executives at the mortgage origination sweatshops were Boomers. They found no good reason to verify income or assets before loaning someone $600,000, because they knew their fellow Boomers at the rating agencies would rate the bundles of these toxic shit loans as AAA so the Boomers on Wall Street could sell them to greater fools. GMAC’s exemplary subprime mortgage arm – Ditech, did a bang up job getting migrant Mexican workers into $450,000 homes in California’s inland empire. As the tsunami of bad debt swept toward shore, delusional Boomers across the land borrowed $500 billion against the inflated value of their McMansions and installed granite counter tops, stainless steel appliances, home theatres, elegant patios, Olympic sized pools, and with the excess home equity, leased a BMW or two. The first devastating tsunami wave hit in 2008 and wiped out billions in faux Boomer wealth. Instead of learning a brutal lesson and reverting back to saving and frugality, the “never say sacrifice” Boomers ventured out to where the waves had subsided looking for more trinkets and treasures.

The next tsunami wave is on its way. The delusional Boomers will be surprised again.

The Boomer persona has been formed over the last five decades and the country will deal with the consequences for decades to come. The clean cut Beaver Cleaver children of the 1950s turned into the pot smoking Dobie Gillis of the 1960’s, then into the slimy Gordon Gekkos of the 1980s and ultimately into the eternal wealth seeking Gollums of today.

This Boomer debt orgy over the last thirty years would have made Caligula blush. Of course, none of this could have happened without the Creature from Jekyll Island. I will address this aspect of our fate in Fistful of Dollars – Part Two.

Now for the righteous indignation from the Boomers that think I have unfairly lumped them all together as one. Their reactions are predictable. Even though they have had the means, the power and the time to reverse the course of USS Titanic, they plowed full steam ahead into the abyss. The GI Generation is dead. Generation X doesn’t hold the reins of power. The Boomer generation needs to look in the mirror to recognize who is to blame. I’m sure there are a few good Boomers out there somewhere, but as a generation they have failed this country and our unborn generations miserably.

Whenever I get an idea for an article I plan to keep it short and sweet. But it never seems to work out that way. Once I start typing, the articles tend to grow exponentially. It happened again with my attempt to make sense of how the United States of America managed to screw our finances up so badly, that an epic collapse is within view to people with their eyes open to facts and the truth. You don’t end up in the predicament we find ourselves in today due to a couple minor mistakes over a short time frame. It took thousands of horrible choices, colossal doses of delusion, a heaping of stupidity, and a mountain of denial over decades to put us on the brink of economic collapse. An unholy amalgamation of demographics, fiat currency, debt, taxes, power and greed have led us to this point. Next we experience collapse, revolution and ultimately, retribution.

Since I’ve identified four major rationales for our impending doom, I’ve decided to write a four part series that can be read in small doses, rather than one enormous article. I don’t want anyone to miss tonight’s episode of Dancing With the Stars, get distracted from the Royal Wedding preparations, or skip the best reality TV show ever – Ben Bernanke’s press conference, while reading an 8,000 word article about the end of America. The four part series will have a Clint Eastwood theme. For a Few Dollars More will address the Baby Boomer impact on America’s decline. A Fistful of Dollars will examine how the creation of the Federal Reserve and the income tax in 1913 set us on a path to ruin. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

Over the last few weeks there seems to be consensus among many financial bloggers, whose credibility is far more trustworthy than the corporate mainstream media, that the country is teetering on the verge of economic collapse due to the complete capture of the government, financial, regulatory, and media by a small group of oligarchs. They have also been described as the super rich, plutarchs, ruling elite, and scum sucking leeches. The bloggers that I have the utmost respect for, including Jesse, Charles Hugh Smith, Mike Shedlock, Yves Smith and Gonzalo Lira have all come to the logical conclusion the horrific economic situation of the country is a direct result of the greed, corruption, fraud, and plundering by a powerful connected group of rich financiers operating without fear of being brought to justice by the authorities.

While pondering the ruminations of these dedicated truth tellers, I was reminded of the Clint Eastwood Spaghetti Western For a Few Dollars More. The quotes above are representative of living in the USA today. There are supposed to be courageous, loyal and honest sheriffs that protect the citizens from crime, corruption and evil doers. But, just as we saw in the Old West of Clint Eastwood movies, the sheriffs are always corrupt and bought off by the evil cattle barons. In a world where life has no value and you can’t rely on law enforcement to protect your interests, the citizens eventually will need to turn to bounty hunters to take care of the bad guys. The bounty hunters of truth reside on the internet. They reside at Zero Hedge, Jesse’s Café Americain, Of Two Minds, Mish, Chris Martenson, and dozens of other anarchist websites. When you can’t trust your government, your bankers, your church, your media, or mega-corporate CEOs, you need to seek the truth where it can be found. The insightful bloggers who courageously print the truth on a daily basis have unanimously concluded that a small band of powerful elite have accumulated undue influence and control over this country, having brought it to the verge of economic collapse. How did this happen? Who is responsible? Why were they permitted to gain this power?

Boomers Come of Age

“If those in charge of our society – politicians, corporate executives, and owners of press and television – can dominate our ideas, they will be secure in their power. They will not need soldiers patrolling the streets. We will control ourselves.” – Howard ZinnWhenever I direct any blame for our economic woes towards the Baby Boom generation they react as expected. They blame the GI Generation for creating the welfare state. They declare that Generation X and the Millenials are just as greedy and self centered as the Boomers. Boomers are great at blaming, ridiculing and acting pompously, while taking no responsibility for their actions and more importantly their inaction. This generation cannot avoid their responsibility for the state of affairs. They like to take credit for their stand against the Vietnam War and their protests against the man during the 1960s. They don’t like to take credit for turning into materialistic, greedy, selfish, short-term focused bastards. When a generation of 76 million people decides to go in a particular direction, the country will go in that direction. While blaming FDR and the GIs who stormed the beaches of Normandy for creating the unfunded Social Security and Medicare liabilities, the Boomers have been voting since the mid-1960s and have been in control of corporate America and the levers of government since the early 1980s.

The U.S. Congress is dominated by Baby Boomers today and has been dominated by this generation since the 1990s. The Senate has 60 Boomers out of 100, while the House of Representatives has 254 Boomers out of 435 members. Boomers occupied the White House from 1992 through 2008. They have had the political power and control of the agenda for two decades and have failed miserably. Rather than do what was best for the country for the long-term, they took the expedient, easy, vote getting route. Promise more than you could ever deliver and let future generations worry about the consequences. Not one true noble statesman has arisen from this generation of myopic, self centered “Me Generation” political hacks. Even as the country nears the precipice, they continue to address the great issues of the day with talking points supplied by other Baby Boomer PR maggots from Park Avenue. These weasels care not for the country, but worry only about poll numbers and the next election cycle. An apathetic public, dominated by the Baby Boom generation, has the attention span of a gnat. As long as they can make the lease payment on their Escalade, use one of their 15 credit cards at the Mall, be entertained by 600 cable TV stations, play with the latest iSomething, live in their McMansion for two years without making a mortgage payment and consume massive quantities of fast food, then any thoughts of future generations or civic duty are unnecessary. Live for today has been the rallying cry for the Boomer generation. Pot was their drug during the 1960s. Debt has been their drug since 1980.

The drug (debt) dealer for the Baby Boom generation has been the Wall Street mega-banks, coincidentally, run by Boomers. The entire corrupt financial industry is being run by Boomers. The CEOs, CFOs, and the thousands of Harvard MBA VPs that created the fraudulent derivative scheme to bilk billions from clueless municipalities, pension funds and American taxpayers are all Boomers. It is no coincidence that the great debt delusion began in the early 1980’s. Jim Kunstler captured the essence of Boomer transformation:

“The Baby Boomers came back from the land, clipped their pony tails, discovered venture capital, real estate investment trusts, securitization of “consumer” debt, and the Hamptons. Greed was good.”

The Boomer CEO hall of scam has been built on the brilliance and financial acumen of Lloyd (god’s work) Blankfein, Charlie (keep dancing) Prince, Jamie (friend of Obama) Dimon, and the king of the Boomers, Hank (the system is sound) Paulson. These mainstays of crony capitalism led the Boomer charge of greed, greed and more greed. The Baby Boomer generation has been the proverbial pig in a python working its way through the decades as presented below. By 1985, Boomers had entered the work force in full force with the entire generation between the ages of 25 and 42. It will be a great day when the python craps this pig of a generation out the other end.

It is not a coincidence the National Debt growth has far outstripped GDP growth since 1980. Boomers had been spoiled their whole lives and felt they deserved the goodies today while passing the bill to future generations. They voted for politicians who promised them more benefits, more programs, more subsidies, more tax breaks, more military adventures, and more pleasure. And this was “paid for” with more debt. Thirty five years of government debt declining as a percentage of GDP was reversed over the next thirty years starting in 1980, pushing it past the 90% tipping point in the last year. The country is over-indebted to the tune of $9 trillion on a current basis and $100 trillion on a long term accrual basis.

There is no better picture of Boomer decadence and myopia than an historical view of the national savings rate. The parents of the Boomers understood the meaning of sacrifice and investing in the future of the country. During World War II they bought US War Bonds to support the cause. From 1950 through 1985, the savings rate consistently ranged between 7% and 12%. Americans had this odd notion that if you saved more than you spent, you actually got ahead in life. Excess savings were used to invest in new plants and equipment that were used to produce goods and employ more Americans. By 1985, the Boomers considered these notions as quaint and old fashioned. The savings rate methodically declined until it went negative in 2006, just prior to the worldwide financial conflagration. Our inspirational Boomer president George (Mission Accomplished) Bush while waging two wars of choice, asked for the ultimate sacrifice from the Boomers. He solemnly urged them to buy a GM SUV with $0 down and 0% interest for 7 years, so we could defeat the terrorists. The Boomers who ran GMAC were more than happy to make loans to people with no income so they could “purchase” a $40,000 ostentatious gas guzzling hog. They were doing their patriotic duty for the good of the nation. It brings a tear to my eye just thinking about it.

The Boomers not only heeded George’s call, but they did him proud by buying 8,000 sq ft McMansions with $0 down and negative amortization ARMs. Luckily, the executives at the mortgage origination sweatshops were Boomers. They found no good reason to verify income or assets before loaning someone $600,000, because they knew their fellow Boomers at the rating agencies would rate the bundles of these toxic shit loans as AAA so the Boomers on Wall Street could sell them to greater fools. GMAC’s exemplary subprime mortgage arm – Ditech, did a bang up job getting migrant Mexican workers into $450,000 homes in California’s inland empire. As the tsunami of bad debt swept toward shore, delusional Boomers across the land borrowed $500 billion against the inflated value of their McMansions and installed granite counter tops, stainless steel appliances, home theatres, elegant patios, Olympic sized pools, and with the excess home equity, leased a BMW or two. The first devastating tsunami wave hit in 2008 and wiped out billions in faux Boomer wealth. Instead of learning a brutal lesson and reverting back to saving and frugality, the “never say sacrifice” Boomers ventured out to where the waves had subsided looking for more trinkets and treasures.

The next tsunami wave is on its way. The delusional Boomers will be surprised again.

The Boomer persona has been formed over the last five decades and the country will deal with the consequences for decades to come. The clean cut Beaver Cleaver children of the 1950s turned into the pot smoking Dobie Gillis of the 1960’s, then into the slimy Gordon Gekkos of the 1980s and ultimately into the eternal wealth seeking Gollums of today.

This Boomer debt orgy over the last thirty years would have made Caligula blush. Of course, none of this could have happened without the Creature from Jekyll Island. I will address this aspect of our fate in Fistful of Dollars – Part Two.

Now for the righteous indignation from the Boomers that think I have unfairly lumped them all together as one. Their reactions are predictable. Even though they have had the means, the power and the time to reverse the course of USS Titanic, they plowed full steam ahead into the abyss. The GI Generation is dead. Generation X doesn’t hold the reins of power. The Boomer generation needs to look in the mirror to recognize who is to blame. I’m sure there are a few good Boomers out there somewhere, but as a generation they have failed this country and our unborn generations miserably.

It is not easy to destroy the greatest empire in the history of mankind. The 20th Century was the American Century, but as with all empires, the combination of hubris, monetary debasement, imperial overreach and delusional overconfidence have set in motion the inevitable downfall of the American Empire. The policies, decisions, beliefs, and institutions implemented over decades have led the country to the threshold of financial disaster. Based on my observations, a catastrophic combination of demographics, fiat currency debasement, titanic levels of debt, smothering taxation, power in the hands of the few and Wall Street greed have led us to peak Empire. It will be downhill from here as we experience collapse, revolution and ultimately, retribution for the guilty and presumed guilty. I have already addressed the Baby Boomer generation’s contribution to our current plight, to the delight and accolades of Boomers across the land in For a Few Dollars More – Part One. The Boomers were a victim of their size and the timing of their arrival on the scene of empire collapse. Their delusions of debt based wealth and me first attitude could not have been satiated without the creation of the Federal Reserve and the institution of the personal income tax in 1913.

“When a man’s got money in his pocket he begins to appreciate peace.” – Joe – Fistful of Dollars

“Every town has a boss.” – Joe – Fistful of Dollars

In the Old West of the 1800’s, before the creation of the Federal Reserve, money in your pocket meant gold or silver. If Joe were to repeat that line today, he would change it slightly:

“When a man thinks he’s got money in his pocket he begins to appreciate the good things in life like McMansions, BMWs, government provided retirement, government provided healthcare, and delusions of ever increasing wealth.”

Man made inflation is a glorious invention for the men who invented it. For the people who deal with it every day, not so much. Joe knew that every town had a boss. If you didn’t know who the boss was in the United States of America before 2008, you know now. Ben Bernanke and the Federal Reserve Bank of the United States is the boss of this town.

In a true capitalist system, organizations and people who assumed too much risk and made poor decisions would have failed. But the United States does not have a capitalist system. We have a corporate fascist economic system where a small cartel of bankers, military weapons suppliers, and mega-corporations set the agenda for the country through their complete capture of politicians and the mainstream corporate media. At the height of the crisis in 2008, President George Bush revealed whose side he chose:

“I’ve abandoned free-market principles to save the free-market system, to make sure the economy doesn’t collapse. I feel a sense of obligation to my successor to make sure there is not a, you know, a huge economic crisis. Look, we’re in a crisis now. I mean, this is — we’re in a huge recession, but I don’t want to make it even worse.”

George Bush was born with a silver spoon in his mouth. He was not trying to save the free-market system, because we didn’t have a free market system. He was saving his fellow billionaires under the cover of saving the average American. Bush knew as much about saving our economic system as he knew about when to declare mission accomplished in Iraq. He turned the task of saving the free market system over to his multi-billionaire Goldman Sachs Secretary of Treasury Hank Paulson and the real boss of Washington DC, Ben Bernanke. These noble American patriots proceeded to save the top 1% richest Americans on the backs of the American middle class. They did it under the guise of keeping the country out of a Depression. Those who committed the crimes and destroyed the worldwide financial system not only didn’t get punished, they were enriched by the actions of Paulson and Bernanke. This entire sordid chapter in the history of the American empire from 2008 until the imminent collapse, sometime before 2015, will leave future historians dumbfounded at the utter insanity and foolishness of the decisions that were made during the death throes of the empire. Not only did George Bush not save the free-market system, but he drove a stake thru its heart.

To boil the entire 2008 financial collapse down to one word, it would be: DEBT.

Three decades of ever increasing levels of consumer, corporate, and government debt eventually led to an unprecedented implosion. It was as predictable in 2008, to those who understand the fiat monetary system, as it was to Ludwig von Mises decades ago:

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

But that wasn’t enough. The executives were large shareholders, so they convinced the Federal Reserve to bail their corporations out whenever they made bad bets. It was a sweet deal if you were a banker. Knowing their lackeys at the Fed had their back, the goliath Wall Street banks used their power and wealth to convince the SEC to waive the 12 to 1 leverage rules so they could leverage their balance sheets 40 to 1. This meant that a 5% loss in their capital and they would be insolvent. The Harvard MBA CEO titans of the financial world created the housing bubble through their creation of fraud inducing mortgage products, a bewildering array of derivative products that even their MBA geniuses didn’t understand, and betting against the derivatives they were selling to their clients. When this toxic brew of fraud and debt exploded in their faces, the value of the assets on their books plunged by 30% to 40% in 2008 and 2009. The 10 biggest financial institutions in the country were effectively bankrupt. An orderly bankruptcy liquidation that wiped out the bondholders, stockholders and top executives was the solution to excessive risk taking and failure.

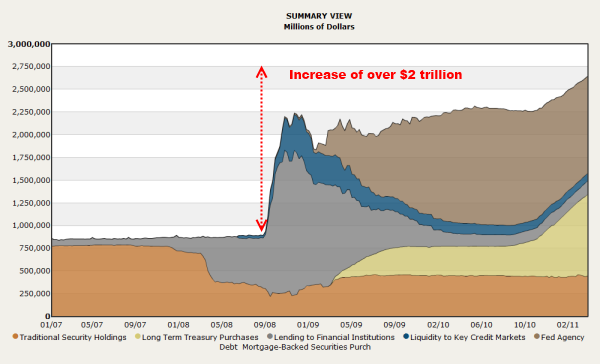

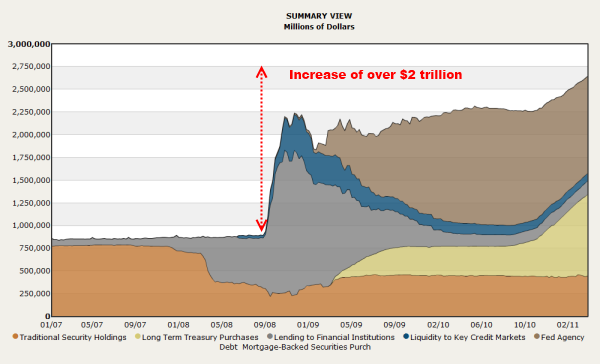

This was an unacceptable solution to the billionaire class that owns half the financial wealth in the country. The President was a multi-millionaire. The Treasury Secretary was a billionaire. There were 250 millionaires in Congress. The top executives of the banks that own and control the Federal Reserve are multi-millionaires. The owners and talking head pundits of the mainstream media are all in the billionaire/millionaire class. The cover story used to bilk $700 billion from middle class taxpayers into the coffers of Wall Street mega-banks was that if we didn’t hand over the loot, the financial system would collapse and a Great Depression would ensue. Every program, policy, and rule change that has been rolled out since September 2008 by the Federal Reserve, Treasury, and Congress has benefitted billionaires, bankers, and politically connected corporations. The Federal Reserve has printed over $2 trillion out of thin air to save the billionaires that have been pillaging the middle class for decades.

The Federal Reserve bought $1.25 trillion of toxic mortgages from Wall Street, allowed these banks to borrow at 0%, threatened the FASB into suspending mark to market accounting so banks could fake the value of their loans, instructed banks to rollover commercial real estate loans as if they weren’t really worth 40% less than the value on their books, and rolled out $600 billion of QE2 in order to create a stock market rally, benefitting their billionaire constituents. The $800 billion stimulus program was shoveled to the corporate friends (contributors) of Congressmen across the land. Cash for Clunkers benefitted government owned car companies. The home buyer tax credit and changing loss carry back rules benefitted mega home builders. Every one of these deeds enriched bankers and billionaires while further impoverishing the working middle class. Real middle class wages continue to fall, unemployment remains near record levels, real inflation in food and energy is running above 10%, senior citizens haven’t gotten a Social Security increase in two years, savers are getting .25% on their savings, home prices continue to fall, and future generations will be stuck with the bill for the billionaire bailout.

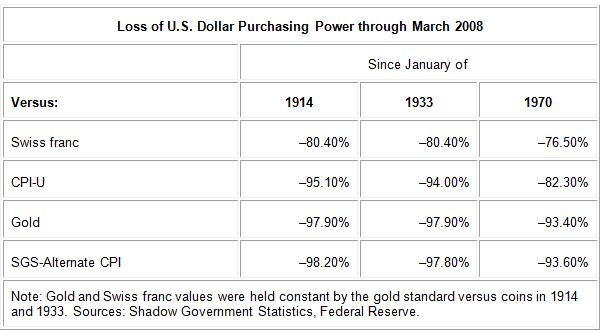

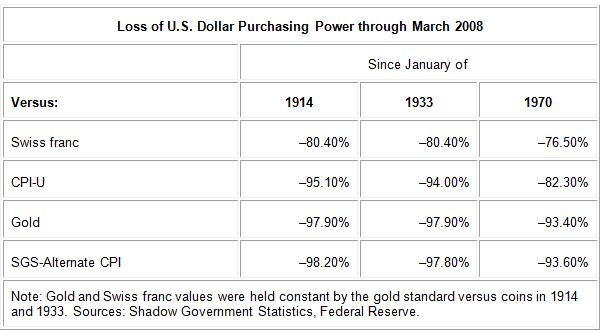

The standard of living for the average American continues to fall. Real household income is lower than it was in 1999. The only reason it increased in the 1980s and 1990s was the huge influx of women into the workforce. Two earners were needed to try and maintain a constant standard of living. Real average weekly earnings are lower today than they were in 1970, even using the government bastardized CPI calculation that has been so massaged since 1982 that it has only resulted in a happy ending for government bureaucrats at the BLS. Calculating the CPI exactly as it was calculated in 1980 reveals the truth of what the Federal Reserve has wrought on working class America, a drastic decrease in their standard of living. The insidiousness of Federal Reserve created inflation has sucked the life out of the middle class and enriched the cocktail party class.

The stealth transfer of wealth from the working middle class to the richest in our society was done through convincing the middle class that buying things with debt made you richer. This delusion was sold by the billionaire owned corporate mainstream media and peddled by billionaire bankers to the masses through credit cards, “creative” mortgage products, easy access to home “equity”, auto leases, and easy financing products. Only in a society where a fiat currency could be printed by a central bank with no requirement that it be pegged to an anchor such as gold, could such a staggering amount of debt be accumulated.

The answer to all these questions is NO. The only beneficiaries have been bankers, billionaires, mega-corporations and the politicians who were bought off by these greedy traitors to the Republic. Anyone with an ounce of sense knows the country got into this mess due to the issuance of mountains of debt that was un-payable based upon any reasonable assessment of future cash flows to service the debt. Consumers could never have increased their wages enough to pay off the credit card, mortgage, home equity, student loan, and auto debt they accumulated since 1980. The government could never collect the amount of taxes needed to pay for the $100 trillion of entitlement promises they have made over the last four decades. By 2008 we had reached peak debt delusion.

The only questions that remained were how would the debt be defaulted on and who would bear the brunt of the default. The Federal Reserve Chairman and the U.S. Treasury Secretary rolled out a master plan that revolved around convincing the masses they were being saved, while actually enriching their masters on Wall Street. Their PR machine and captured mouthpieces throughout the mainstream media and in Congress spun the fear mongering message of Depression if the mega-banks were not handed trillions of taxpayer funds.

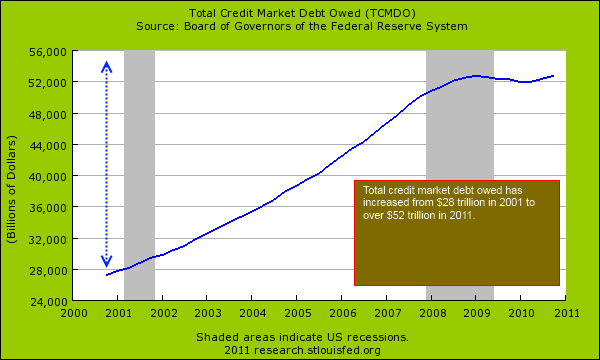

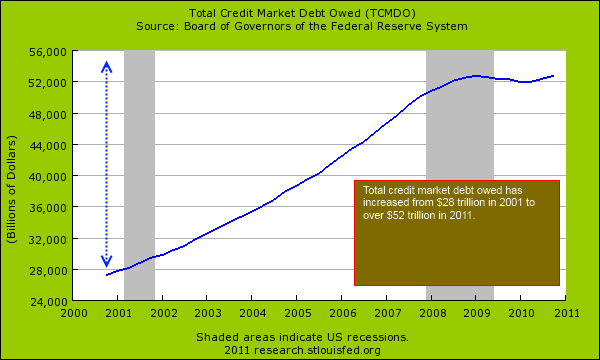

The proof of what did not happen is borne out in the chart below, showing the total credit market debt in the U.S.at $52.6 trillion, $200 billion higher than it was in 2008. If those who had collected billions in fraudulent profits while using unprecedented levels of debt were rightfully required to take responsibility for the catastrophe they caused, the debt levels would have dropped dramatically. The losses would have been borne by those responsible. The economy would have taken a body blow, all Americans would have been hurt, and many billionaires would have become millionaires or even paupers. The debt would have been written off and lessons would have been learned. The remaining banks (there are 8,000 others besides the 10 who control 50% of the deposits) would have followed traditional risk mitigation methods and the economy would have recovered.

But, as you can see, debt was not written off. No bankers were harmed during the making of this fake recovery. No criminal bankers were prosecuted. No government drones took responsibility for their failure. While the masses were distracted by stimulus packages, mortgage moratoriums, Obamacare and reality TV, the debt was shifted from the criminally negligent banks to you. The proof is right on the Federal Reserve website for all to see:

The Federal Reserve has slowly and methodically destroyed the American middle class through relentlessly printing more money and purposefully creating inflation, since its reprehensible creation in 1913. For the last three decades only one voice in the wilderness of Washington DC has fought this banking cabal.

“Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve’s inflationary policies. This represents a real, if hidden, tax imposed on the American people.

From the Great Depression, to the stagflation of the seventies, to the burst of the dotcom bubble last year, every economic downturn suffered by the country over the last 80 years can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial “boom” followed by a recession or depression when the Fed-created bubble bursts. In conclusion, Mr. Speaker, I urge my colleagues to stand up for working Americans by putting an end to the manipulation of the money supply which erodes Americans’ standard of living, enlarges big government, and enriches well-connected elites, by cosponsoring my legislation to abolish the Federal Reserve.” – Ron Paul – Sept 10, 2002

His colleagues in Congress did not stand up to the Federal Reserve in 2002. Instead, they cheered them on as Greenspan’s ultra loose monetary policy led to the greatest housing bubble in history and a financial collapse unparalleled in human history. As the collapse was hurdling down the track in 2006, Representative Paul once again rose in protest against an organization that is rapidly destroying the American dream.

“The coming dollar crisis is not likely to be “fixed” by politicians who are unwilling to make hard choices, admit mistakes, and spend less money. Demographic trends will place even greater demands on Congress to maintain benefits for millions of older Americans who are dependent on the federal government.

Faced with uncomfortable financial realities, Congress will seek to avoid the day of reckoning by the most expedient means available – and the Federal Reserve undoubtedly will accommodate Washington by printing more dollars to pay the bills. The Fed is the enabler for the spending addicts in Congress, who would rather spend new fiat money than face the political consequences of raising taxes or borrowing more abroad.

The irony is that many of the Fed’s biggest cheerleaders are the same supposed capitalists who denounced centralized economic planning when practiced by the former Soviet Union. Large banks and Wall Street firms love the Fed’s easy money policy, because they profit at the front end from the resulting loan boom and artificially high equity prices. It’s the little guy who loses when the inflated dollars finally trickle down to him and erode his buying power. Someday Americans will understand that Federal Reserve bankers have no magic ability – and certainly no legal or moral right – to decide how much money should exist and what the cost of borrowing money should be.” – Ron Paul – July 11, 2006

The dollar crisis is upon us. Congress and President Obama are avoiding the day of reckoning. The Federal Reserve is enabling profligate spending by politicians, while at the same time enriching their masters on Wall Street. Everything being done in Washington DC seems to be the exact opposite of what should be done. I think the fable of the scorpion and the frog describes our situation best. The scorpion asks a frog to carry him across a river. The frog is afraid of being stung, but the scorpion argues that if it stung, the frog would sink and the scorpion would drown. The frog agrees and the scorpion stings the frog during the crossing, dooming them both. When asked why, the scorpion points out that this is its nature. The Federal Reserve is printing money, creating inflation, enriching billionaire bankers, and dooming the country to certain collapse because that is its nature.

My intentions have been foiled again. I realize that my attempt to put our current economic predicament into perspective will now need to be a five part series. . For a Few Dollars More addressed the Baby Boomer impact on America’s decline. A Fistful of Dollars examined how the Federal Reserve’s actions over the last few decades have impoverished the middle class and has placed the country at the brink of collapse, The Good, the Bad, and the Ugly will address the nefarious creation of a central bank and the implementation of a personal income tax in the dreadful year 1913. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

I can’t wait to see how it ends.

“When a man’s got money in his pocket he begins to appreciate peace.” – Joe – Fistful of Dollars

“Every town has a boss.” – Joe – Fistful of Dollars

In the Old West of the 1800’s, before the creation of the Federal Reserve, money in your pocket meant gold or silver. If Joe were to repeat that line today, he would change it slightly:

“When a man thinks he’s got money in his pocket he begins to appreciate the good things in life like McMansions, BMWs, government provided retirement, government provided healthcare, and delusions of ever increasing wealth.”

Man made inflation is a glorious invention for the men who invented it. For the people who deal with it every day, not so much. Joe knew that every town had a boss. If you didn’t know who the boss was in the United States of America before 2008, you know now. Ben Bernanke and the Federal Reserve Bank of the United States is the boss of this town.

Crony Capitalism Pays for the Cronies

Without Federal Reserve intervention in the financial markets since September 2008, the biggest banks in the world would have entered bankruptcy liquidation. The U.S. economy would have experienced a 10% to 20% fall in GDP. The unemployment rate would have soared above 15%. The stock market would have fallen 70%. Wealthy bondholders and stockholders would have seen their wealth cut in half. Incumbent politicians would have all been thrown out of office. The richest Americans, constituting the ruling class, would have borne the brunt of the pain.In a true capitalist system, organizations and people who assumed too much risk and made poor decisions would have failed. But the United States does not have a capitalist system. We have a corporate fascist economic system where a small cartel of bankers, military weapons suppliers, and mega-corporations set the agenda for the country through their complete capture of politicians and the mainstream corporate media. At the height of the crisis in 2008, President George Bush revealed whose side he chose:

“I’ve abandoned free-market principles to save the free-market system, to make sure the economy doesn’t collapse. I feel a sense of obligation to my successor to make sure there is not a, you know, a huge economic crisis. Look, we’re in a crisis now. I mean, this is — we’re in a huge recession, but I don’t want to make it even worse.”

George Bush was born with a silver spoon in his mouth. He was not trying to save the free-market system, because we didn’t have a free market system. He was saving his fellow billionaires under the cover of saving the average American. Bush knew as much about saving our economic system as he knew about when to declare mission accomplished in Iraq. He turned the task of saving the free market system over to his multi-billionaire Goldman Sachs Secretary of Treasury Hank Paulson and the real boss of Washington DC, Ben Bernanke. These noble American patriots proceeded to save the top 1% richest Americans on the backs of the American middle class. They did it under the guise of keeping the country out of a Depression. Those who committed the crimes and destroyed the worldwide financial system not only didn’t get punished, they were enriched by the actions of Paulson and Bernanke. This entire sordid chapter in the history of the American empire from 2008 until the imminent collapse, sometime before 2015, will leave future historians dumbfounded at the utter insanity and foolishness of the decisions that were made during the death throes of the empire. Not only did George Bush not save the free-market system, but he drove a stake thru its heart.

To boil the entire 2008 financial collapse down to one word, it would be: DEBT.

Three decades of ever increasing levels of consumer, corporate, and government debt eventually led to an unprecedented implosion. It was as predictable in 2008, to those who understand the fiat monetary system, as it was to Ludwig von Mises decades ago:

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Federal Reserve – Destroyer of Worlds

The 2008 crash and the 1929 crash were manmade disasters. Alan Greenspan and Ben Bernanke created the atmosphere and conditions that led to the risk taking by bankers, home buyers and consumers. Monetary expansion, excessively low interest rates, the Greenspan/Bernanke Put, disinterest in regulation, and pandering to politicians allowed the party to get out of control. Taking away the punch bowl never crossed their mind. The Federal Reserve is controlled by the major Wall Street banks. These banks were partnerships until the 1980s, with partners personally liable for the actions of their banks. Excessive risk taking meant possible personal bankruptcy. Once they became corporations, excessive risk meant excessive compensation for the executives, with the downside being borne by the shareholders.But that wasn’t enough. The executives were large shareholders, so they convinced the Federal Reserve to bail their corporations out whenever they made bad bets. It was a sweet deal if you were a banker. Knowing their lackeys at the Fed had their back, the goliath Wall Street banks used their power and wealth to convince the SEC to waive the 12 to 1 leverage rules so they could leverage their balance sheets 40 to 1. This meant that a 5% loss in their capital and they would be insolvent. The Harvard MBA CEO titans of the financial world created the housing bubble through their creation of fraud inducing mortgage products, a bewildering array of derivative products that even their MBA geniuses didn’t understand, and betting against the derivatives they were selling to their clients. When this toxic brew of fraud and debt exploded in their faces, the value of the assets on their books plunged by 30% to 40% in 2008 and 2009. The 10 biggest financial institutions in the country were effectively bankrupt. An orderly bankruptcy liquidation that wiped out the bondholders, stockholders and top executives was the solution to excessive risk taking and failure.

This was an unacceptable solution to the billionaire class that owns half the financial wealth in the country. The President was a multi-millionaire. The Treasury Secretary was a billionaire. There were 250 millionaires in Congress. The top executives of the banks that own and control the Federal Reserve are multi-millionaires. The owners and talking head pundits of the mainstream media are all in the billionaire/millionaire class. The cover story used to bilk $700 billion from middle class taxpayers into the coffers of Wall Street mega-banks was that if we didn’t hand over the loot, the financial system would collapse and a Great Depression would ensue. Every program, policy, and rule change that has been rolled out since September 2008 by the Federal Reserve, Treasury, and Congress has benefitted billionaires, bankers, and politically connected corporations. The Federal Reserve has printed over $2 trillion out of thin air to save the billionaires that have been pillaging the middle class for decades.

The Federal Reserve bought $1.25 trillion of toxic mortgages from Wall Street, allowed these banks to borrow at 0%, threatened the FASB into suspending mark to market accounting so banks could fake the value of their loans, instructed banks to rollover commercial real estate loans as if they weren’t really worth 40% less than the value on their books, and rolled out $600 billion of QE2 in order to create a stock market rally, benefitting their billionaire constituents. The $800 billion stimulus program was shoveled to the corporate friends (contributors) of Congressmen across the land. Cash for Clunkers benefitted government owned car companies. The home buyer tax credit and changing loss carry back rules benefitted mega home builders. Every one of these deeds enriched bankers and billionaires while further impoverishing the working middle class. Real middle class wages continue to fall, unemployment remains near record levels, real inflation in food and energy is running above 10%, senior citizens haven’t gotten a Social Security increase in two years, savers are getting .25% on their savings, home prices continue to fall, and future generations will be stuck with the bill for the billionaire bailout.

The standard of living for the average American continues to fall. Real household income is lower than it was in 1999. The only reason it increased in the 1980s and 1990s was the huge influx of women into the workforce. Two earners were needed to try and maintain a constant standard of living. Real average weekly earnings are lower today than they were in 1970, even using the government bastardized CPI calculation that has been so massaged since 1982 that it has only resulted in a happy ending for government bureaucrats at the BLS. Calculating the CPI exactly as it was calculated in 1980 reveals the truth of what the Federal Reserve has wrought on working class America, a drastic decrease in their standard of living. The insidiousness of Federal Reserve created inflation has sucked the life out of the middle class and enriched the cocktail party class.

The stealth transfer of wealth from the working middle class to the richest in our society was done through convincing the middle class that buying things with debt made you richer. This delusion was sold by the billionaire owned corporate mainstream media and peddled by billionaire bankers to the masses through credit cards, “creative” mortgage products, easy access to home “equity”, auto leases, and easy financing products. Only in a society where a fiat currency could be printed by a central bank with no requirement that it be pegged to an anchor such as gold, could such a staggering amount of debt be accumulated.

Delusions of Debt

The bill that has been rung up is in the form of a national debt that has increased by $4.6 trillion since September 2008, a 48% increase in two and a half years. Over this same time frame real GDP has increased by $200 billion, a 1.6% increase in two and a half years. Over this same period, the Federal Reserve has tripled their balance sheet by adding $2 trillion of debt. Think about this for one second. The leaders of the great American empire have burdened future generations with $6.6 trillion of new debt and increased the Gross Domestic Product by $200 billion. Is this a good return on investment? Did the 30 million unemployed and underemployed Americans benefit? Did the 45 million people on food stamps benefit? Did the 11 million households who are underwater in their mortgage benefit? Did the 3 million people who lost their homes in foreclosure since 2008 benefit? Are Americans paying twice as much for groceries and gasoline benefitting? Did the Tunisians, Egyptians, and other poor people around the world benefit?The answer to all these questions is NO. The only beneficiaries have been bankers, billionaires, mega-corporations and the politicians who were bought off by these greedy traitors to the Republic. Anyone with an ounce of sense knows the country got into this mess due to the issuance of mountains of debt that was un-payable based upon any reasonable assessment of future cash flows to service the debt. Consumers could never have increased their wages enough to pay off the credit card, mortgage, home equity, student loan, and auto debt they accumulated since 1980. The government could never collect the amount of taxes needed to pay for the $100 trillion of entitlement promises they have made over the last four decades. By 2008 we had reached peak debt delusion.

The only questions that remained were how would the debt be defaulted on and who would bear the brunt of the default. The Federal Reserve Chairman and the U.S. Treasury Secretary rolled out a master plan that revolved around convincing the masses they were being saved, while actually enriching their masters on Wall Street. Their PR machine and captured mouthpieces throughout the mainstream media and in Congress spun the fear mongering message of Depression if the mega-banks were not handed trillions of taxpayer funds.

The proof of what did not happen is borne out in the chart below, showing the total credit market debt in the U.S.at $52.6 trillion, $200 billion higher than it was in 2008. If those who had collected billions in fraudulent profits while using unprecedented levels of debt were rightfully required to take responsibility for the catastrophe they caused, the debt levels would have dropped dramatically. The losses would have been borne by those responsible. The economy would have taken a body blow, all Americans would have been hurt, and many billionaires would have become millionaires or even paupers. The debt would have been written off and lessons would have been learned. The remaining banks (there are 8,000 others besides the 10 who control 50% of the deposits) would have followed traditional risk mitigation methods and the economy would have recovered.

But, as you can see, debt was not written off. No bankers were harmed during the making of this fake recovery. No criminal bankers were prosecuted. No government drones took responsibility for their failure. While the masses were distracted by stimulus packages, mortgage moratoriums, Obamacare and reality TV, the debt was shifted from the criminally negligent banks to you. The proof is right on the Federal Reserve website for all to see:

- Financial institutions reduced their debt from $17.1 trillion in 2008 to $14.2 trillion today.

- The Federal & state governments increased their debt from $8.7 trillion in 2008 to $11.9 trillion today.

- The GSEs (Fannie, Freddie, Sallie) increased their debt from $3.2 trillion in 2008 to $6.4 trillion today.

- Corporations increased their debt from $7.0 trillion in 2008 to $7.4 trillion today.

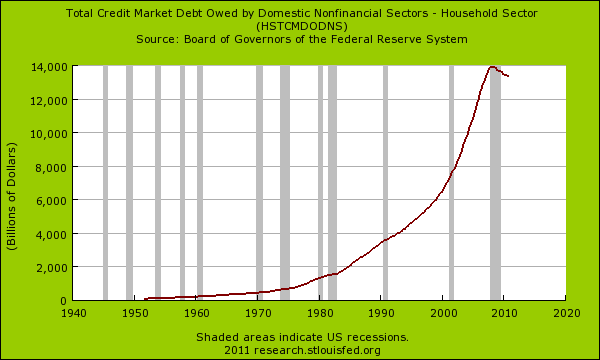

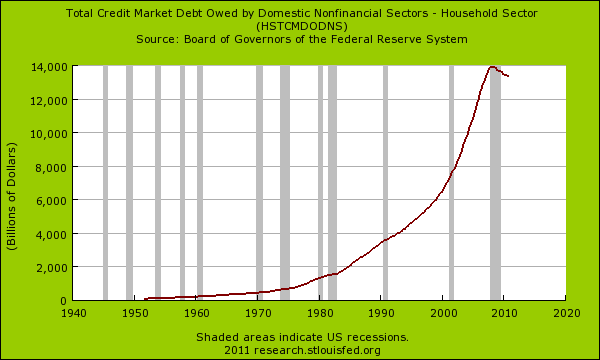

- Household debt declined from $13.8 trillion in 2008 to $13.4 trillion as the Federal Reserve backstopped the write-off of $600 billion of bad debt by the banks.

Champion of the Middle Class

By extending the debt, shifting it to the taxpayer and pretending it is payable, the Federal Reserve and your government have chosen, to use its weapon of choice since inception in 1913 – INFLATION, to default on the debt. It is not a new tactic, it is their only tactic.

The Federal Reserve has slowly and methodically destroyed the American middle class through relentlessly printing more money and purposefully creating inflation, since its reprehensible creation in 1913. For the last three decades only one voice in the wilderness of Washington DC has fought this banking cabal.

“Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve’s inflationary policies. This represents a real, if hidden, tax imposed on the American people.

From the Great Depression, to the stagflation of the seventies, to the burst of the dotcom bubble last year, every economic downturn suffered by the country over the last 80 years can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial “boom” followed by a recession or depression when the Fed-created bubble bursts. In conclusion, Mr. Speaker, I urge my colleagues to stand up for working Americans by putting an end to the manipulation of the money supply which erodes Americans’ standard of living, enlarges big government, and enriches well-connected elites, by cosponsoring my legislation to abolish the Federal Reserve.” – Ron Paul – Sept 10, 2002

His colleagues in Congress did not stand up to the Federal Reserve in 2002. Instead, they cheered them on as Greenspan’s ultra loose monetary policy led to the greatest housing bubble in history and a financial collapse unparalleled in human history. As the collapse was hurdling down the track in 2006, Representative Paul once again rose in protest against an organization that is rapidly destroying the American dream.

“The coming dollar crisis is not likely to be “fixed” by politicians who are unwilling to make hard choices, admit mistakes, and spend less money. Demographic trends will place even greater demands on Congress to maintain benefits for millions of older Americans who are dependent on the federal government.

Faced with uncomfortable financial realities, Congress will seek to avoid the day of reckoning by the most expedient means available – and the Federal Reserve undoubtedly will accommodate Washington by printing more dollars to pay the bills. The Fed is the enabler for the spending addicts in Congress, who would rather spend new fiat money than face the political consequences of raising taxes or borrowing more abroad.

The irony is that many of the Fed’s biggest cheerleaders are the same supposed capitalists who denounced centralized economic planning when practiced by the former Soviet Union. Large banks and Wall Street firms love the Fed’s easy money policy, because they profit at the front end from the resulting loan boom and artificially high equity prices. It’s the little guy who loses when the inflated dollars finally trickle down to him and erode his buying power. Someday Americans will understand that Federal Reserve bankers have no magic ability – and certainly no legal or moral right – to decide how much money should exist and what the cost of borrowing money should be.” – Ron Paul – July 11, 2006

The dollar crisis is upon us. Congress and President Obama are avoiding the day of reckoning. The Federal Reserve is enabling profligate spending by politicians, while at the same time enriching their masters on Wall Street. Everything being done in Washington DC seems to be the exact opposite of what should be done. I think the fable of the scorpion and the frog describes our situation best. The scorpion asks a frog to carry him across a river. The frog is afraid of being stung, but the scorpion argues that if it stung, the frog would sink and the scorpion would drown. The frog agrees and the scorpion stings the frog during the crossing, dooming them both. When asked why, the scorpion points out that this is its nature. The Federal Reserve is printing money, creating inflation, enriching billionaire bankers, and dooming the country to certain collapse because that is its nature.

My intentions have been foiled again. I realize that my attempt to put our current economic predicament into perspective will now need to be a five part series. . For a Few Dollars More addressed the Baby Boomer impact on America’s decline. A Fistful of Dollars examined how the Federal Reserve’s actions over the last few decades have impoverished the middle class and has placed the country at the brink of collapse, The Good, the Bad, and the Ugly will address the nefarious creation of a central bank and the implementation of a personal income tax in the dreadful year 1913. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

I can’t wait to see how it ends.

No comments:

Post a Comment