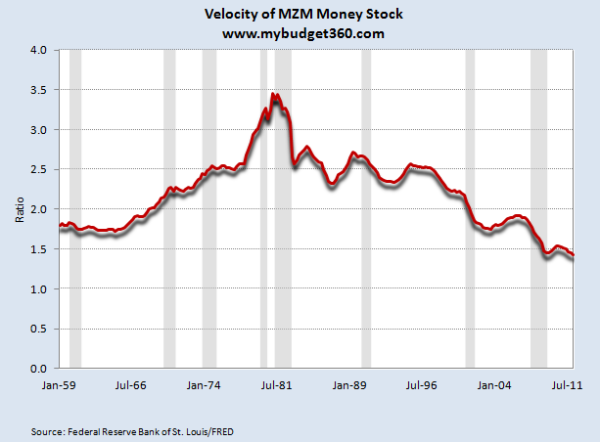

Chart #1 – Velocity of money

We are getting less bang for each buck that is being injected into the economy. Sure, we can promise unlimited amounts of debt to the public but you have to have actual production to back this up. Need we remind you of the people with $20,000 annual incomes buying $500,000 and $600,000 homes? Being able to finance your debts is core to our global economy. You see what happens when this breaks down. Banks are willing to lend in today’s market but they are now performing due diligence. And guess what? Not many are qualified to borrow. So the money sits earning interest for banks while more debt is chasing the same amount of goods. If simply printing money was a good thing the Fed’s trillion dollar spending spree would have made this nation much richer instead of bankrupting the middle class through a hidden tax with inflation. If you examine the above chart, the velocity of money has come to a screeching halt yet here we are bailing out banks only so they can give each other multi-million dollar bonuses for essentially passing on bad losses to taxpayers.

Economist Paul Samuelson was quoted as saying:

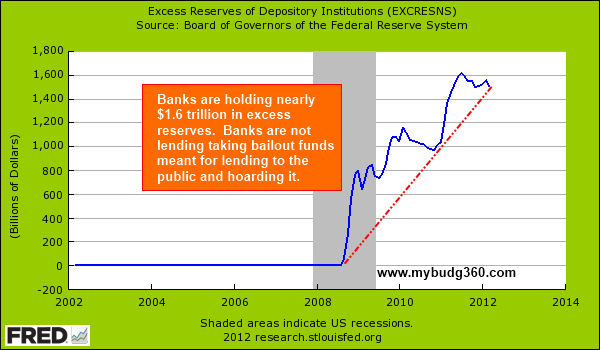

“In terms of the quantity theory of money, we may say that the velocity of circulation of money does not remain constant. “You can lead a horse to water, but you can’t make him drink.” You can force money on the system in exchange for government bonds, its close money substitute; but you can’t make the money circulate against new goods and new jobs.”Chart #2 – Excess reserves

Based on the fewer number of qualified borrowers, banks have simply hoarded the money as seen by the excess reserve chart above. In fact, banks are willing to take the low Federal Reserve interest rate instead of injecting it into the economy where consumers can use the funding. If the goal was to get money into the hands of consumers, why not just cut a check for $100,000 to each American? As preposterous as that sounds, it is a better policy compared to giving banks trillions of dollars in backstops and pretending they were somehow going to put this back into play for consumers. This leads us to consumer debt.

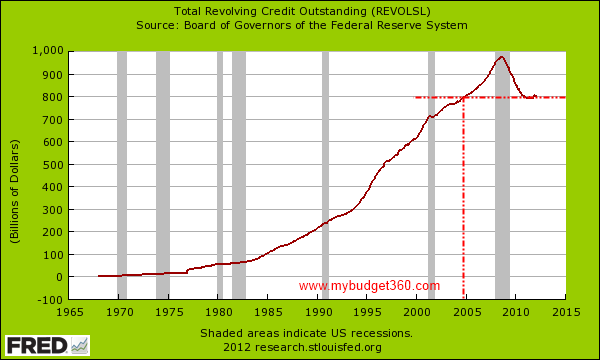

Chart #3 – Revolving credit

This crisis for the first time in a generation actually saw a massive contraction in credit card debt that is still occurring. This is a monumental event. A big part of this has come from bankruptcies and not exactly people paying off debt in the old fashion way. Even elite areas like Orange County have seen massive spikes in consumer bankruptcies:

Source: OC Register

Nearly touching $1 trillion in credit card debt the contraction has been severe and part of the deleveraging taking place on the balance sheet of households. What does this say about the American consumer? That a certain peak debt situation was hit. Since we know most of the economy runs on consumption, then what made up for the gap?

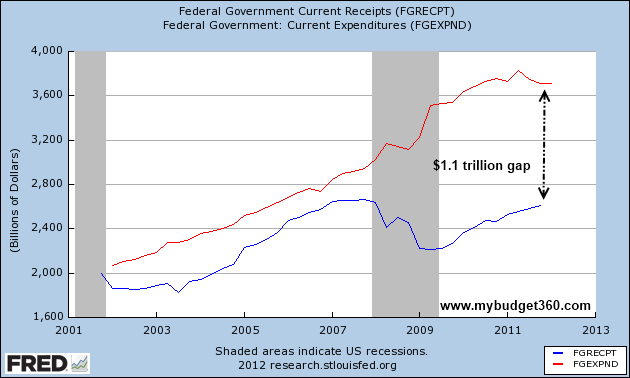

Chart #4 – government spending

The government has been spending money like no other. The latest data shows a current $1.1 trillion gap between revenues and expenses. Think about this, we are running a current government deficit of close to 10% of GDP! We look at places like Greece and chide them for spending more than they can take in and a similar pattern is happening here.

As you’ll notice from the chart above, government spending has risen and with more baby boomers retiring and drawing on Medicare and Social Security expenses will likely move higher up. Will revenues keep pace? The recent job trends have been for lower paying jobs. You need jobs for a healthy economy or you face disintegration. Which leads us to Europe.

Chart #5 – Spanish unemployment

Greece has a GDP of $300 billion. Spain has a GDP of $1.4 trillion. You already saw what issues Greece caused global markets but what if a place like Spain goes deep into a depression? During the Great Depression, the US headline unemployment rate was 25 percent. Spain is there today. Spanish youth have an unemployment rate above 50 percent. Spain actually has a public debt to GDP ratio lower than that of the US. Spain is actually entering their implosion of their housing market largely held by their cajas, or banks. Much of their real estate debt is held internally which doesn’t bode well for their economy.

Spain is in a depression. Greece is in a depression. England is in a recession. France is going to witness major political changes. This will leak over. The European Union as a trading bloc is bigger than the United States. The issue again? Too much debt for what is being produced.

Too much debt and deep power with financial institutions

At the core, this is a global debt problem. Too much debt is flooding the system. Central banks are not omnipotent and don’t have an answer to every question challenging our financial system. Investment banks are predatory by nature. For example, shamed defunct investment bank Lehman Brothers was actually looking at paying hundreds of millions of dollars to top executives only a few months before their imminent collapse. These are the same banks trading to one another toxic investment waste and where the Fed stepped in to bail them out. In times of financial crisis the obvious truth may be hard to find but one axiom holds true; having too much debt with too little income is a recipe for disaster. Shakespeare understood this:

“Neither a borrower nor a lender be…”Looks like we simply have too many lenders and not enough qualified borrowers.

No comments:

Post a Comment